Metals’ use in medical devices dates to the late 1800s, when surgeons experimented with biodegradable magnesium implants to fix bones. Then, 1937 saw the first cobalt-chromium cup for use in the hip. By the following year, doctors had completed a full hip replacement with stainless steel.

While cobalt chromium and stainless steel are still used in orthopedics today, titanium has also become a standard option. Meanwhile, other materials and alloys continue to come to market driven by demands for attributes like strength, biocompatibility and even absorption.

Here’s a look at some of the leading metals in the orthopedic market and what’s pushing the development of new materials and manufacturing processes, as well as a look at what may be next.

A Menu of Metals

FDA lists the most common metals used in medical implants as titanium, cobalt chrome and stainless steel.

Titanium, particularly its alloy of 6% aluminum and 4% vanadium, exhibits high strength and resistance against bodily fluids, some of the most corrosive in the world. It’s also nontoxic and biologically compatible with human tissue and bone, making it an ideal material for joint reconstruction, trauma or sports medicine. Cobalt-chrome-moly alloys (28% chromium, 6% molybdenum) are also widely used in orthopedic implants because of their high stiffness and wear performance. Finally, a variety of implant-grade stainless steel is used for medical implants and surgical tools due to its low cost and easy cleaning as well as strength and corrosion resistance.

Over the decades, orthopedic device companies have heavily invested in the development of metals to provide favorable advantages over traditional options.

Trabecular Metal

Trabecular metal is made from pure elemental tantalum. The tantalum is processed into a porous biomaterial that is structurally similar to bone, resulting in excellent biocompatibility. Trabecular metal was first introduced by Implex, an implant designer and manufacturer, in the late 1990s. Zimmer acquired Implex in 2003 and is now the exclusive user of the metal.

Robert Poggie, Ph.D., now President of the consulting firm BioVera, was part of the Implex research team. “Today, people are using 3D printing to create a similar product with titanium, but at the time, processing tantalum to make it porous so that it was better accepted by bone was groundbreaking,” he said.

Trabecular metal’s high porosity (up to 80%) allows it to support bony ingrowth. It also offers corrosion resistance and high fatigue strength, which contributes to its continued use in a variety of implants, arthroplasty and bone augmentation in joints in which a lot of the bone has been lost. The material’s success has been documented in its more than 19-year clinical history.

Oxinium

While ceramic components are sometimes used in place of cobalt-chrome-moly hip and knee implants to reduce abrasion, their stiff and brittle nature can limit designs and increase the risk of component fracture. Seeing a need for a bearing technology with the wear performance of ceramics and the impact strength and low stiffness of metal, Smith+Nephew invented Oxinium material, a zirconium alloy metal substrate that transforms into a ceramic zirconium oxide outer surface when heated in air, causing oxygen to diffuse into the surface.

“The mechanical strength and low stiffness of this ‘ceramicized metal’ make it suitable as an alternative to cobalt-chrome-moly without a change in component design or surgical technique,” said Gordon Hunter, Ph.D., Principal Manager of Material Science at Smith+Nephew and also leader of Oxinium’s development.

The material’s unique combination of the metal’s mechanical strength with ceramic’s wear resistance has led to nearly 25 years of clinical use in more than two million knee and hip replacements. Hunter said that renewed research focused on how fretting and crevice corrosion can lead to device damage and the release of cobalt and chromium ions has helped surgeons favor alternatives such as ceramic and Oxinium heads, as well.

Absorbable Metals

Temporary metal implants, such as stainless steel or titanium screws used to repair bone fragments, require a second operation for removal. However, absorbable implants are changing this paradigm.

For example, Finnish medical device company Bioretec focuses solely on bioabsorbable and bioresorbable implants for pediatric and adult orthopedics, including pins, nails and screws. Chief Technology Officer Kimmo Lähteenkorva said that surgeons have hesitated to use titanium-based implants with pediatric patients, especially in Europe, and that bioabsorbable implants can help decrease patient pain while improving biocompatibility.

Last year, Bioretec acquired Austria-based BRI.Tech due to interest in its work on an alloy based solely on metals occurring naturally in the human body – such as magnesium, calcium and zinc – rather than rare earth metals. However, Lähteenkorva said that even magnesium alloys are not resilient or strong enough for some extremely demanding absorbable applications. Bioretec has started several material research projects to develop an entirely new type of absorbable composite material and will begin an animal study in the second quarter of 2020.

Traditional Metal Preferences

Overall, the industry remains biased toward using existing materials and alloys. This is no surprise due to the capital, research and regulatory investments new materials require.

Device companies, suppliers and raw material providers will likely seek to develop manufacturing processes to drive innovation over the advancement of new metals.

“People are very reliant on existing materials,” said Adam Griebel, Senior Research and Development Engineer for Fort Wayne Metals. “It doesn’t mean new alloys won’t show up. We see them all the time, so we’re confident that they will find their place. But it takes longer. If there are new processes that can improve the existing materials to make them work, getting those types of solutions to market can happen more quickly.”

For example, Fort Wayne Metals is using equal-channel angular pressing (ECAP) to offer improved strength and fatigue life in proven materials like titanium.

“For a given chemistry, you can change the properties in a really broad window solely based on the way you manufacture it,” he said. “That’s a reality a lot of people in the industry don’t fully appreciate.”

Manufacturing and Supply Chain Trends

Initially, metal medical devices were machined by removing material from a bar of metal and shaping it into an intended design. The acetabular cup and the ball/head for hip implants are often made this way and then highly polished. However, some components aren’t easy to machine, such as in the knee. As the industry grew, manufacturers needed a way to produce these types of devices efficiently. Investment castings provided one good solution. This process involves the creation of a three-dimensional pattern to make a mold or investment.

In the 1990s and early 2000s, specialist forging companies made advancements in near-net-shape forging, which helped achieve stronger components from bar stock with tight tolerances. As the name implies, the initial manufacturing of the item is very close to its final, or net, shape, reducing the need for as much subsequent machining and thereby eliminating cost. This process works well for hip stems, and also in other bones like shoulders.

“Manufacturers have done an excellent job in developing processes for both machining and forging to create implants and instruments that reduce the amount of subsequent work and material removal,” said Steve Smith, President of Edge International and Chair of the International Titanium Association’s Medical Technology Committee. “That’s a big factor in doing machining from solid bar. The raw materials used are expensive, so the less that has to be removed, the lower the cost of the part.”

Device companies continue to prioritize the elimination of metal waste, and they look to suppliers and manufacturing partners for solutions, said Tim Mangas, Director of Sales for Banner Medical.

“They are asking us to provide the metal in a condition that takes waste out of the value stream,” he said. “Instead of traditional 12-foot long bars, they may ask us to provide the material in the form of pucks or 5-inch long blanks. As an alternative to simply providing a flat bar, we can machine the material into blocks or even net shapes that greatly reduce their material prep and machining time.”

Mangas said that Banner offers vendor-managed programs in which they procure the material, process it into tightly-toleranced, customer-specific parts and then release the parts at regular intervals.

“Many customers also want their bars to be heat-treated prior to machining,” he said. “Due to this, we stock heat-treated material so our customers can purchase smaller volumes directly from our inventory and eliminate the additional weeks needed to heat treat metal bars.”

Lead times, stock critical materials and flexible agreements are also important to device companies that seek to squeeze cost out of manufacturing.

“The medical device world has dramatically changed the sourcing and supplying of materials in recent years,” said Gaurav Lalwani, Medical Applications Development Engineer at Carpenter. “As a result of reimbursement activity, OEMs and contract manufacturers place more focus on inventory and cash flow than ever before, and those of us in the raw material supply chain must find ways to provide flexibility to the industry without compromising the quality of the material in any way.”

3D Printing

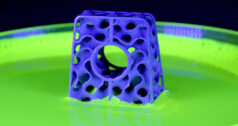

3D printing, or additive manufacturing, has found numerous applications, especially in fabricating complex structures or patient-specific designs that are not practical for conventional casting, forging and machining. The method involves the use of a laser or electron beam to melt metal powders into a solid part that is built layer by layer.

Orthopedic companies are using 3D printing to make titanium porous devices for better integration with bone in the spine, knee and hip, such as in Smith+Nephew’s REDAPT hips. The company’s system includes shells and augments that it said likely would be cost-prohibitive or impossible with other forms of manufacturing. Hunter said that 3D printing can produce titanium with a porosity of up to 80% in regions where initial bone fixation will occur as well as friction bumps at the bone interface to increase early stability of the implants and still maintain a solid structure in regions where strength is required, such as around the variable angle locking screw holes.

“As Smith+Nephew designers have said, ‘If you can imagine it, you can print it,’ ” Hunter said.

Materials providers continue to make investments in powder to meet the uptick in demand for 3D printing. Still, the technology has a way to go in terms of increased speed and decreased cost before it can become competitive with the mass production of traditional machining.

Future Focus on Metals

Orthopedics remains ripe for metal advancements, which will primarily focus on patient satisfaction.

Of note, regulators in Europe and the U.S. are currently evaluating the biological response to metals. Under the new European Medical Device Regulation, cobalt is viewed as a cancer-causing substance and devices containing cobalt may need to be labeled as such. In 2019, FDA published draft guidance on the information needed in premarket submissions of products that use nitinol, released research on metal-on-metal implants and noted potential future scrutiny of materials during premarket and postmarket activities.

The handful of experts we spoke to on metals highlighted the following three priorities.

- Surgeons will continue to look for solutions that provide better patient satisfaction. This is driving the commercialization of smaller implants to be used in minimally-invasive procedures. Reduced implant size requires materials with higher strength and toughness, which will push advances in processing and fabrication technology.

- With patient comfort and safety in mind, absorbable implants are expected to gain traction as more are introduced to the market.

- Surface modifications on traditional implants that include drug components or chemistries to inhibit infection and enable faster healing are also being developed.

There’s tremendous potential for the global growth of metal implants due to demographics and orthopedic companies’ ability to penetrate new countries.

“It’s interesting to look at places like China where you see the growth in the middle-income market that enables people to have additional disposable income so that they can go ahead and have those types of surgery that can be considered more elective than essential,” said Edge International’s Smith. “I don’t anticipate a reduction in the use of metals in implants, because there’s going to be continued growth and demand in the overall global medical device market; the demand curve is still very much on an upward trajectory.”

Kathie Zipp is an ORTHOWORLD Contributor.