In response to frequent merger and acquisition activity at the OEM level, and to stay competitive in the orthopaedic industry, suppliers are engaging in their own strategic initiatives. Through M&A, suppliers can expand capabilities and production to attract OEMs that may be looking for fewer suppliers, and they’ve broadened their geographic reach, making them more accessible and attractive to device companies.

Of the 37 orthopaedic industry acquisitions that closed in 2014, nearly one-third occurred between suppliers. These 12 transactions represent an increase from the nine reported mergers in 2013 and four in 2012.

Industry experts and top level executives expect further consolidation at the supplier level based on recent deals and overall trends. Their insights follow.

Robert Kinsella, President of Kinsella Group: Tecomet started the track here with the acquisitions of 3D Medical and Symmetry Medical’s OEM Solutions.

We’ll see a few, maybe three, but certainly not more than three large—$200 million-plus— players in this industry, and I think it’s going to happen over the next 12 to 18 months.

Many demands are placed on the supplier to be able to meet OEM requirements. Resources must be available for machine time, plant space must be responsive to new product introductions. It’s more challenging today because the companies themselves, the big OEMs, are much bigger after consolidation. Larger salesforces are covering more hospitals, so rollout demands are much greater. OEMs need large-player suppliers to respond to those.

Bill Dow, CEO, Tecomet: This merger (with OEM Solutions) has piqued people’s interest and, I think, given more recognition to the fact that as our customers get bigger, they want to deal with bigger entities that offer them more security both from a quality system standpoint and a fiscal viability standpoint.

You’ll continue to see consolidation among the bigger contract manufacturers, but just as importantly, with the thousands of smaller contract manufacturers that are going to have to find a bigger partner in this business space to maintain viability moving forward.

Tobias Buck, Chairman, President and CEO, Paragon Medical: Risk mitigation and economics are forcing consolidation at all levels. This will continue for OEMs and their supply base. Today’s economic context, coupled with amplified regulatory compliance at all classifications levels (1, 2, 3), in concert with an overall compression in procedural reimbursement thresholds from CMS, will reinforce the cadence and magnitude of consolidation.

Kinsella: The supply chain is the major place you’ll see acquisitions. As the companies try to rationalize their supply chains, they’re going look to larger players.

We believe that the smaller companies, the sub-$20 million contract manufacturers, are going to need a home; otherwise, I’m not sure they’re going to be able to exist in the industry. If you’re doing ten to $15 million in business, it’s pretty tough to reduce costs. The players whom we think are going to be doing those acquisitions are likely to be the mid-tier, the $100 million plus or minus players.

Tom O’Mara, Executive Vice President, Autocam: As OEMs combine, the supply base will be affected. It is certain that contract manufacturers will increasingly be required to have tight control of all down-stream operations and sub-contractors. This will likely narrow the sub-supply base to reduce variation and ensure that all steps in the value stream are aligned to the quality standards required to support the OEM’s requirements.

Buck: The Tier I and Tier II OEMs have conveyed the message of decreasing their supply base for years. Their systemic behavior and necessary risk management doctrine will only reinforce and reaffirm this thesis. It is an informed argument to compress the supply base and move away from transactional sourcing to category and system level sourcing. You will also continue to see more and more Medical Device Logistics support from the strategic supply base.

Jorge Ramos, Chief Administrative Officer, Orchid Orthopedic Solutions: We don’t have empirical evidence that OEMs have reduced the number of suppliers, but many of our OEM customers are telling us that reducing the number of suppliers is one of their goals. The combination of OEMs seeking to reduce the number of suppliers and the other favorable aspects of working with full-scale suppliers leads us to believe that M&A activity at the contract manufacturer level will continue to be relatively high.

The contract manufacturing space remains quite fragmented around the globe. We suspect that all areas of the contract manufacturing space will see some M&A activity. OEMs seem look at sourcing more strategically than on a case-by-case purchase.

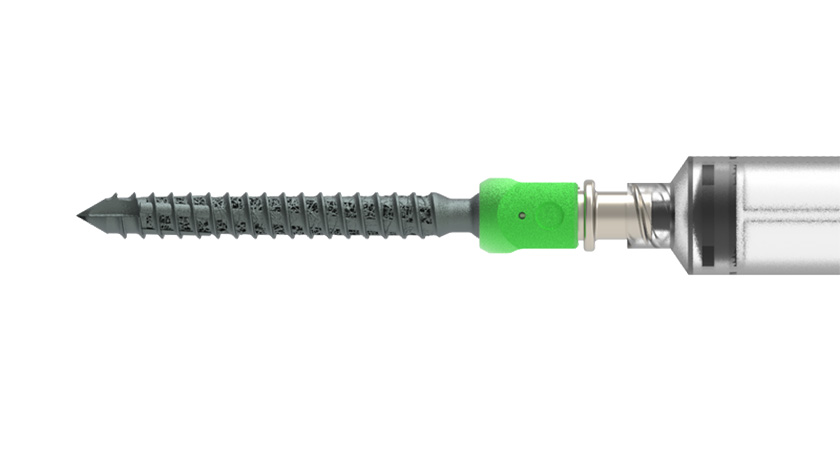

Kinsella: Will there be some technology acquisitions? Yes. Will it be in additive manufacturing (AM)? I think companies will be buying machines as opposed to making acquisitions.

There may be some acquisitions in the metal injection molding (MIM) area, which I think is beginning to grow. In the case of AM, certainly know-how is required to be able to effectively run AM operations, but the basis of that technology is the machine. In the case of MIM, the basis of that technology is trade secrets and know-how; it’s really invested in people.

Magnue Rene, CEO, Arcam: The industry is very fragmented, and the introduction of new technologies like AM is a challenge to many companies, both in terms of investments and in terms of competence.

O’Mara: We view (Southeastern Technology) more as a merger of complimentary organizations versus a traditional “acquisition.”

The combined enterprise’s scale also puts us in a better position to handle large projects. We have a significant base of machining and finishing technology, combined with an access to growth capital, which will be expanded to meet the demands of our OEM customers.

Rene: Arcam has worked with DiSanto as a strategic partner for 18 months, together offering additively manufactured implants manufactured through Arcam’s EBM technology. The acquisition was a natural step to further strengthen the alliance and our offering to the market.

Dow: Yes, we will continue to look at acquisitions that make sense and add new capabilities that we don’t have. For example, we don’t do plasma coating right now; we outsource it. If we could find a business that would help us bring that into our own offerings, that would be attractive.

We probably won’t look as much as we have in the last couple of years as we integrate the OEM Solutions business, but we will keep our ear to the ground and if the right opportunity comes up, we won’t hesitate to pursue it.

| Acquirer | Acquired | When |

| Okay Industries | Reliance Laser | February 2014 |

| Arcam | AP&C Division from Raymor Industried became a subsidiary of Arcam | February 2014 |

| Disanto Technology became a subsidiary of Arcam | September 2014 | |

| Cretex Companies | S. Wickstrom Manufacturing | July 2014 |

| Tecomet | 3D Medical Manufacturing | August 2014 |

| Symmetry Medical’s OEM Solutions business | December 2014 | |

| Cadence | Three operating business units of Plainfield Precision Holdings | August 2014 |

| Precision Engineered Products | Holmed (business division of Advanced Precision Products) | September 2014 |

| 3D Systems | Medical Modeling | April 2014 |

| LayerWise | September 2014 | |

| Materialise | OrthoView | October 2014 |

| CoorsTek Medical | Nanosurface Industries | November 2014 |

| Autocam Medical | Southeastern Technology (SET) | December 2014 |

| Paragon Medical | Michael Bubolz GmbH’s medical device segment | January 2015 |

A version of this article originally appeared in ORTHOKNOW®.

Hannah Corcoran is an Editorial & Media Assistant at ORTHOWORLD.