Titanium has long been the preferred material for spinal implants, but associated complications such as screw loosening and stress shielding underscore the need for fresh solutions. As the demand for advanced implants continues to increase and evolve, product engineers are including enhanced materials, coatings and surface structures in their designs.

The advent of porous metals, bioactive coatings and advanced polymers are expanding design possibilities, functionalities and surgical approaches that weren’t previously possible. These factors are unlocking improved osseointegration, enhanced durability and patient-specific applications that are shaping the future of spine care.

However, not all implants are created equal, points out Ryan Campion, Chief Strategy and Development Officer at Nexxt Spine. “The way they’re designed and manufactured makes a significant difference, so design intentionality is really important,” he said.

Here’s how orthopedic companies are bridging the latest design and manufacturing technologies with advanced materials and cutting-edge surfaces to revolutionize spinal implants.

New Possibilities

Before the future of spinal implants can materialize, manufacturers must first overcome the fundamental challenge of replacing bone with non-organic materials.

“The fact is that we’re replacing spinal discs with a static surrogate,” said Matthew Shomper, Founder and Principal Engineer of Not a Robot Engineering, an engineering consultancy firm focused on advanced 3D-printed mechanical implants. “And when that static replacement is 30 to 50 times stiffer than what was there, even if we’re fusing things together, we create a mechanical problem where the implant is too stiff and strong.”

The goal of any implant design should address this problem, either through the functionality of the material itself or the geometry of the design — or, ideally, a combination of both.

“The biggest challenge we’ve always tried to solve in device engineering is creating an implant that stabilizes the spine for fusion or creates an environment that allows for movement preservation,” said Shomper, who also lends his technical services to orthopedic and spine companies like Allumin8. “A lot of new designs and materials are attempting to address that challenge by drastically reducing stiffness or creating an environment for bone to remodel or heal.”

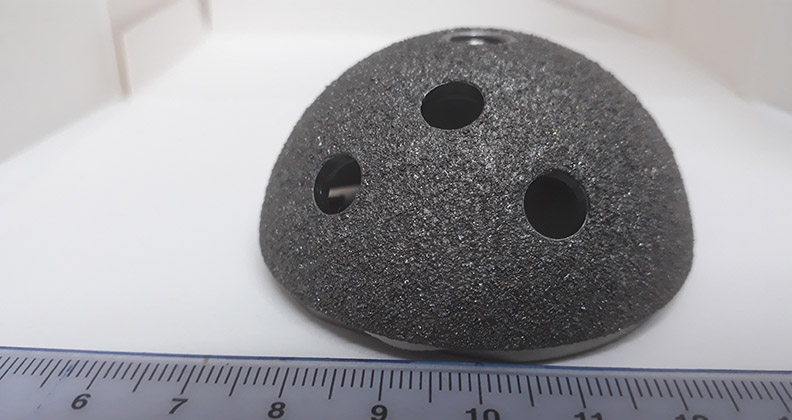

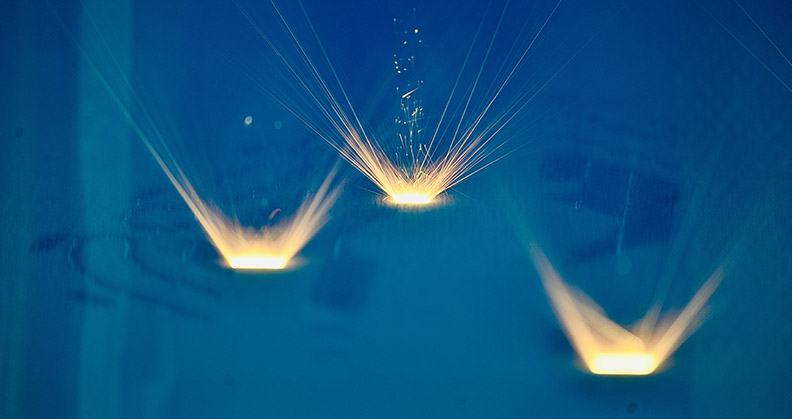

For example, new additive manufacturing processes enable traditional titanium — even a range of materials — to be transformed into porous lattice structures like Allumin8’s Integr8 pedicle screw and Nexxt Spine’s Nexxt Matrixx product family, which spans cervical implants, vertebral body replacement devices, sacroiliac fusion screws and more.

“That geometry would be very difficult, if not impossible, to make using subtractive manufacturing,” Campion said. “Now you can design features, geometries and surfaces to help with the body’s natural healing process to not only improve fusion, but also to minimize subsidence and maintain correction.”

In fact, Nexxt Spine published a prospective study of its 3D-printed interbody implants in the Journal of Neurosurgery and Spine that demonstrated these outcomes over time.

While engineers remain optimistic about new approaches to designing and manufacturing traditional materials like titanium, 3D printing offers even more opportunities to push the limits of less common materials.

“No matter how much material you carve out of an implant, 3D-printed titanium is still 100 times the stiffness of the native bone it’s trying to replace. All it takes is for one strut in a lattice to get overloaded to the point where the failure cascades and breaks dynamically,” Shomper said. “With new materials and metals that have lower ductility or lower modulus, we’re able to do more creative things with the geometry to optimize the impact of the implants in the body.”

Shomper points to new metal alloys that are more ductile than titanium, polymers that exhibit resorbable properties and even ceramic/titanium alloys and ceramic coatings like hydroxyapatite that help accelerate bone growth and unlock new possibilities for implants.

Campion also calls out tantalum as a not-so-new material that’s being used in new ways and for new applications. The volume of published literature documenting tantalum’s clinical outcomes in spine surgery more than doubled between 2015 and 2020. Numerous studies show excellent surgical results due to the metal’s similar modulus to bone, high porosity, bend strength, stability and corrosion resistance.

Another advantage that materials like polymers and ceramics offer over titanium is their appearance in follow-up imaging.

“Even with a see-through lattice structure, titanium creates a scattering on x-rays that makes it difficult to remove the artifacts, so it’s challenging to tell if good bone is actually growing or not,” Shomper said. “One of the biggest advantages that new materials provide is the ability to correct that issue and actually see, post-operatively, exactly what’s happening at the surgical site.”

Finishing Touches

Regardless of the material or manufacturing methods that are used to create spinal implants, post-processing plays a huge role in how the devices ultimately perform in the body. As product developers continue to innovate new surface technologies and coatings, these finishing touches make a big difference for bone fusion.

“It’s not just the material itself. While that’s important, how they’re managed after you start the manufacturing process is also critical,” Campion said. “There’s a host of different ways to treat and coat these implants, which impacts their surface finish and strength. The material, post-processing, heat treatment, stress relief and surface technology all interact to affect the material properties.”

For example, Nexxt Spine has developed several proprietary post-processing capabilities and a stress-relieving process in a vacuum-sealed vessel that Campion said only a handful of companies own.

“There have been myriad studies that look at the optimal roughness that bone likes to grow into, everything from the macro to the micro to the nano range,” Shomper said. “You really need texturing down at that nano-level, but most 3D printing processes cannot achieve it. So, you need to combine 3D-printed macro- or micro-features with a surface technology, some sort of acid etch or anodization, to create the best environment for bone to grow.”

Shomper highlighted the FDA-cleared nanotube surface technology developed by Nanovis, which has been shown to improve the osseointegration of titanium implants. Medtronic recently acquired nanotechnology assets from Nanovis for use with PEEK interbody fusion devices.

Nanovis’ nanoVIS Ti Surface Technology can be applied to pure titanium and titanium alloys to permanently restructure the implant surface at the nano scale, rather than simply coating it. (Editor’s note: Read more about the technology in this month’s Finishing Touch on p. 58.) This modification is designed to accelerate and strengthen biological fixation.

When proteins absorb onto the nano-engineered surface, their spacing triggers signals that promote bone cell proliferation.

These nano-scale features also play a role in reducing bacterial attachment, supporting a healthy inflammatory response and enhancing vascularization.

Nanovis describes its approach as focusing on four pillars of healing: creating an optimal surface for cell attachment, encouraging vascular growth, modulating inflammatory response and reducing bacterial adhesion. By carefully engineering implant surfaces, Nanovis aims to achieve targeted healing outcomes.

Certain nano dimensions have been shown to enhance osseointegration, while others improve soft tissue attachment. Building on these insights, Nanovis is developing a portfolio of tunable surfaces to meet different orthopedic requirements.

This allows for the precise engineering of nanostructures that can encourage strong tissue integration where desired or remain hydrophobic to prevent attachment in specific areas.

Nanovis has initially applied this technology to spinal interbody devices and pedicle screws with the potential to expand into additional orthopedic applications.

The Medtronic deal demonstrates the value that companies place on innovative surface technologies, prompting other manufacturers to keep a close eye on this space.

“The advent of coatings and texturing onto devices is an emerging frontier that will continue to be important,” Shomper said.

Personalized Solutions

The biggest potential that both Shomper and Campion see for the future of device innovation is the emergence of patient-specific products that replace conventional off-the-shelf spinal implants.

“New materials, 3D-printed structures, surface technologies — they’re all funneling toward this idea of bespoke products,” Shomper said. “If an implant is going into somebody’s body, shouldn’t it be designed for them? This idea of a load-matched, geometry-matched implant is really fascinating because the one-size-fits-all approach doesn’t make a lot of sense.”

The production speed and personalization capabilities of 3D printing make patient-specific spinal implants a more cost-effective possibility. But where this idea really gains traction is with the use of bioresorbable polymers that provide temporary stabilization to enable bone healing before gradually dissolving into the body, eliminating the need for a permanent implant.

“I think that’s ultimately where the market is headed,” Campion said. “A host of bioresorbable materials have been tried in the past, and some of those didn’t necessarily play out, but there’s still a lot of opportunity there.”

Campion envisions using artificial intelligence and machine learning to guide surgeons toward the best material choices for individual implants based on the patient’s clinical indications and anatomical nuances.

“That’s the future in personalizing implants to get the best outcome,” he said. “But that possibility is challenging for companies and regulatory bodies to keep up with.”

Proven Results

To successfully introduce new materials and surface technologies into spinal implant applications, manufacturers must overcome several significant hurdles.

Some companies pave the way for other players to dodge some of the regulatory burden by working closely with FDA to establish master files that can be easily adopted.

The next challenge, according to Shomper, will involve trying to convince experienced surgeons to replace the materials they’ve been using for decades as spine implants have evolved from titanium to polyetheretherketone (PEEK) to 3D-printed titanium and now 3D-printed PEEK.

“PEEK is biocompatible, but it’s relatively inert. Unlike titanium, which has a surface energy that bone will grow into, PEEK doesn’t create any reaction, so bone essentially just ignores it,” Shomper said. “A lot of surgeons saw issues with PEEK cages and non-fusions, so even if you say, ‘We’ve got 3D-printed PEEK impregnated with hydroxyapatite (HA) to make it more osteoconductive,’ there’s still an adoption problem.

“The vast majority of surgeons are very conservative, and they don’t want to introduce risk, so they’ll keep using what’s familiar to them,” he continued. “It could be an incredibly cool technology, but that matters very little if surgeons aren’t willing to use it.”

The turning point, he said, will be sufficient evidence-based research that demonstrates positive clinical outcomes.

For example, Curiteva commercialized a proprietary 3D-printed PEEK cervical implant featuring HAFUSE nano-texturing technology that recently surpassed 5,000 vertebrae levels successfully treated.

“It’s going to take some time for the outcomes to be cataloged and analyzed,” Shomper said, “but it’s that type of retroactive feedback that’s going to lead to greater adoption.”

Campion, likewise, emphasized the importance of evidence, like the prospective study that Nexxt Spine published to validate product performance. By showing surgeons proof that innovative implants fit patients better and fuse more effectively with bone, manufacturers will demonstrate how new materials solve clinical problems.

“I’m all for advancing the science, but it comes down to the evidence,” he said. “Doing something because you can doesn’t necessarily mean that it’s needed. It comes down to proving that our efforts to advance implant designs improve patient outcomes.”

BB

Brooke Bilyj is a contributing writer.