Spine companies are operating in an intensely competitive market that for years rewarded share and scale. That dynamic is shifting.

Today, enabling technologies are no longer optional add-ons but essential components of strategic growth. The companies rising in spine are building strong technology portfolios.

Mid-tier players such as Orthofix and ATEC are proving that investing in enabling technologies can pay off, while newer entrants like Augmedics and OnPoint Surgical continue to attract investment in augmented reality–based navigation.

At the same time, larger companies are reevaluating what truly drives differentiation. Notably, Stryker’s divestment of its spine implant business to VB Spine didn’t include the Mako Spine robot. The move underscored the importance that Stryker has staked in enabling technology in its efforts to compete with spine’s biggest players.

“Mako has the necessary capabilities, a strong install base and a sophisticated team that’s developing the platform,” said Keith Evans, Vice President and General Manager of Stryker’s enabling technology business. “It became an obvious choice for us to go all in on Mako. We’ve aligned those efforts with the work being done by the hip, knee and shoulder teams on the same platform.”

In this environment, incremental improvements to implants are no longer enough to secure lasting market share. While implant innovation remains essential, differentiation increasingly depends on the technologies that surround the implant — tools that enable more precise placement, optimize surgical efficiency and generate actionable data.

Enabling technologies are emerging as the connective tissue between preoperative intent and postoperative results. For spine companies, they offer not only clinical value, but also a strategic pathway to sustained relevance in a crowded and fast-evolving field.

Strategic Integration

In June, Highridge Medical sold its EBI Bone Healing Division to Avista Healthcare Partners as part of a strategic decision to focus on core spine solutions and advancements in surgical technology.

Part of Highridge’s spine strategy is built on seamless integration with widely used navigation platforms. The HIGHRIDGE Universal Navigation System was designed for compatibility with the Medtronic StealthStation System and the SureTrak II clamps and arrays. The company’s Vital Navigation System is designed to allow the navigation of bone preparation instruments and pedicle screws in the spine.

That integration allows surgeons to incorporate Highridge’s instruments without impacting established surgical workflows.

“Not being disruptive is crucial,” said Konrad Linke, Global Director of Marketing at Highridge Medical. “It’s a much smoother transition to add functionality into what surgeons are already doing rather than overhauling it.”

Highridge is exploring partnerships with smaller innovators to bring unique navigation and imaging solutions to market faster. For Highridge, that nimbleness is an advantage over larger, more siloed corporations.

“We can focus entirely on what advances the procedure for our customers,” Linke said. “We don’t need to navigate competing priorities from other divisions.”

That advantage doesn’t diminish the complexity of building or integrating enabling technology platforms. “Developing navigation or AI in spine care comes with significant challenges,” Linke said. “The R&D investment is substantial, and integration must be seamless with existing implant systems and workflows.”

For example, the development process for Orthofix’s 7D Flash Navigation System started with surgeon and O.R. staff input on everything from device footprint to how it would be used in real-life clinical settings.

The 7D System eliminates reliance on ionizing radiation devices, offers surgeon-controlled operation without additional O.R. staff and requires no reconfiguration of existing surgical rooms to handle heavy, space-consuming robotic systems.

“Surgeons want more capability, but they don’t want more complexity,” said Beau Standish, Ph.D., Chief Enabling Officer at Orthofix. “If your technology slows down the case, creates more steps or doesn’t fit with existing hospital infrastructure, adoption stalls.”

The necessity for compatibility with everyday users is based on more than convenience; it also impacts the system’s economics. Hospitals facing capital expenditure freezes are more likely to adopt enabling technologies that can be integrated without major infrastructure changes, staffing resources or long training curves.

“The winners in the market will be companies offering technology solutions that are plug-and-play and scalable,” Dr. Standish said.

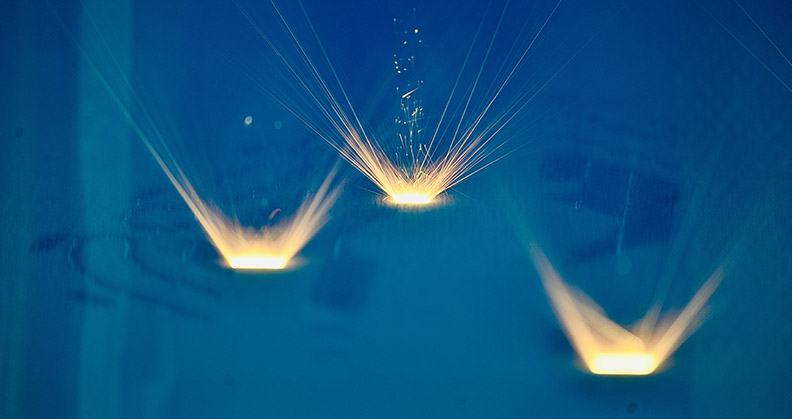

Orthofix’s 7D FLASH Navigation System uses visible light to create a three-dimensional image for surgical navigation.

Differentiator to Standard

In some surgical specialties, the tipping point for enabling technologies has already passed. In neurosurgery, for example, navigation is so deeply entrenched that operating without it is almost unheard of.

Spine surgery is now moving along a similar path. What was once a differentiator for early adopters is rapidly becoming a baseline requirement, particularly in complex and minimally invasive cases where the margin for error is small and the demand for efficiency is high.

“In neuro, navigation is already a given — it’s the standard of care,” Linke said. “It’s evolving to the same level in spine. It’s not just about patient benefits like smaller incisions or reduced infection risk. It’s also about making the surgical team’s job safer and less physically demanding.”

Radiation exposure is one of the clearest examples of this team-focused value.

“Within the first 10 years of practice, a spine surgeon can reach a lifetime’s worth of exposure,” Linke said. “Navigation and robotics take that exposure way down. That’s something everyone understands.”

The increased use of enabling technology in spine is also generational. Younger surgeons, who trained on these systems from the outset of their residencies, are helping to normalize technology-driven approaches. “They’re not interested in proving they can operate without it,” Linke said. “They’re interested in improved outcomes and career longevity.”

This mindset, coupled with increasingly technology-friendly fellowship programs, is accelerating the replacement of traditional freehand surgical techniques with image-guided and robot-assisted workflows.

Dr. Standish frames this change in terms familiar to anyone in the technology sector. “Implants will always matter, but they’re now part of a broader surgical ecosystem,” he said. “Enabling technologies are the operating system for your hardware.”

In this model, the implant is just one application running on a much larger platform that connects preoperative planning, intraoperative guidance and postoperative assessment into a continuous feedback loop that improves patient outcomes.

Gaining Buy-in

Even the most intuitive technology requires an intentional adoption plan. Dr. Standish describes this process as a predictable curve: see it, try it, trust it, teach it. Moving surgeons quickly along that curve requires targeted, hands-on experiences.

For Orthofix, consistent cadaver labs and side-by-side comparisons with legacy navigation systems have been impactful for demonstrating the speed and accuracy of the 7D System. Early adopters often mentor peers through their first cases, building trust through real-world demonstration.

“The pinnacle is peer-to-peer advocacy,” Dr. Standish said. “When a colleague demonstrates improvements in workflow or outcomes, that’s far more persuasive than a marketing campaign.”

Linke stressed the importance of onboarding the entire O.R. team, not just the surgeon. “You can’t leave them alone after purchase,” he said. “Proper and continuous support prevents buyer’s remorse and ensures the technology is used consistently.”

Accelerating adoption requires more than just great technology, Linke added. “It demands trust, relevance and ease of use,” he said. “Surgeons are usually excited at first, but unless the entire O.R. team is trained and supported, their enthusiasm fades.”

Linke said demonstrating clinical and economic value builds momentum, while responsive on-site support during initial cases helps build trust and ensures a smooth transition.

The primary barrier to mainstream adoption remains cost — not just purchase price, but development investment and the time required to produce compelling clinical evidence.

Macroeconomic factors like interest rates and hospital budget cuts compound the challenge. At the same time, buyer expectations are rising: Hospitals want proof of improved efficiency, safety and economics before committing capital investment dollars to new technologies.

“Hospitals, payers and surgeons are under pressure now more than ever before to improve outcomes, reduce complications and make every minute in the O.R. count,” Dr. Standish said. “Enabling technologies can personalize care, streamline workflow and provide measurable value in ways a standalone implant cannot.”

Inroads to Growth

Both Linke and Dr. Standish believe the future of enabling technologies lies in the data they produce. The immediate applications are workflow-focused — predicting needed implant sizes, guiding rod bending during minimally invasive cases or tracking sources of procedural delay. “Small workflow improvements add up,” Linke said.

He also pointed out that the potential for reduced revision rates afforded by navigation and robotics make a compelling case for cost-effective and efficient patient care.

Over the longer term, aggregated data can inform patient-specific surgical planning, optimize inventory management and even serve as a marketing tool by quantifying outcomes. Dr. Standish sees AI-driven personalization as the logical next step.

“The new frontier is precise, personalized spine surgery,” he said. “Every implant trajectory, every alignment check — verified in real time.”

While robotics has captured most of the headlines in recent years, Linke predicts that the most transformative short-term advances will come from imaging and navigation systems.

“We’ll see breakthroughs in low-dose imaging and AI-based reconstruction from just a few fluoroscopy shots,” he said. “That’s a big leap in reducing radiation exposure and cost while maintaining the visibility surgeons need.”

Looking further ahead, Linke sees the greatest opportunities in the convergence of AI-driven planning, real-time navigation and intraoperative imaging. “This will transform spine surgery from a manual, variable process into a data-rich, precision-guided discipline,” he said.

The most competitive platforms, he added, will not only assist in surgery but also learn from each case, enabling predictive analytics, personalized surgical planning and continuous improvement to surgical techniques.

These advances could help standardize complex procedures and make difficult techniques more accessible, reducing disparities in care and expanding access to minimally invasive spine surgery.

“As hospitals and payers increasingly demand value-based care, platforms that can demonstrate improved outcomes, reduced complications and lower the total cost of care will have the edge,” Linke said.

Dr. Standish also views imaging and AI as foundational to the future. Orthofix is already integrating advanced optics and AI-driven planning into the 7D System to move closer to fully personalized, real-time spine alignment verification. The goal: faster, safer and more cost-effective procedures.

Linke and Dr. Standish agree that the industry is entering a golden era for enabling technologies, driven by rapid prototyping, more accessible advanced manufacturing and faster software development cycles. Still, they caution that the window to establish a competitive advantage is narrow.

Orthofix has emerged as one of the clearest examples of how technology can drive growth in today’s spine market. The company’s Voyager Earn Out program for the 7D System is fueling adoption and has directly translated into stronger performance. In the first half of 2025, U.S. placements of the 7D System increased 66% compared to the same period a year ago.

“Advances in hardware, software and prototyping speed mean we can iterate faster than ever,” Dr. Standish said. “The companies that marry that speed with solutions that are scalable, intuitive and data-driven will lead the next phase of spine market growth.”

Even more telling, the Voyager Earn Out program’s customers are exceeding their contracted spinal hardware and orthobiologics purchase commitments by an average of 50%. This demonstrates the leverage of navigation as a growth engine, not only for system placements but also for the broader implant and biologics business.

Companies that understand this dynamic will be better positioned to emerge as leaders in a segment that will reward strategic growth over simple market share.

KK

Kendal Kloiber is a contributing editor.