Additive manufacturing is evolving into an essential offering for orthopedic OEMs that want to differentiate their portfolios from the competition. Companies now see 3D printing as a critical tool for faster innovation, greater design flexibility and broader product offerings.

Its influence reaches far beyond latticed spinal cages and patient-specific implants. Additive manufacturing is now improving manufacturing agility.

“If you don’t capitalize on additive manufacturing’s potential in orthopedics, you’re behind the competition,” said Davy Orye, Head of Additive Minds consulting at EOS. “But just having additive isn’t enough anymore. Companies must understand how to leverage the technology to unlock its true advantages.”

Flexible Production. Additive manufacturing enables flexibility that subtractive methods cannot match, especially for companies exploring new product categories or launching niche devices with low production volumes.

“Additive manufacturing unlocked the ability to control lattice structures in a way that was previously impossible,” Orye said. “You can now precisely control geometry, porosity, relative density and even surface roughness. That’s become a standard differentiator in implant design.”

Personalization is becoming essential, and demand is growing for surgeon-specific instruments that accommodate different techniques, handle shapes or angles. Additive manufacturing allows companies to make various designs in a cost-effective way.

Startups often cannot afford the capital investment needed to get started in additive manufacturing. Contract manufacturers with 3D printing capabilities give them a way to launch differentiated products. If the business grows or is acquired, production can be scaled up or moved in-house using the same ecosystem.

Large OEMs look for other benefits such as redundancy across sites, secure supply capacity and validation for high-volume production.

“Additive manufacturing allows companies to scale more fluidly across the product lifecycle,” Orye said.

It is especially valuable for producing uncommon sizes needed in low quantities, where additive manufacturing can work alongside conventional techniques to avoid costly retooling or recasting.

Mainstream Applications. Early orthopedic additive manufacturing applications focused on high-value items like spinal cages and acetabular cups. Falling per-part costs and faster print speeds are expanding its use to more standard implants such as femoral components, especially for small-batch or late-stage product lines.

“Additive manufacturing used to be too expensive for large, traditional implants,” Orye said. “But now, with improvements in print speed, machine costs and material costs, it’s cost competitive.”

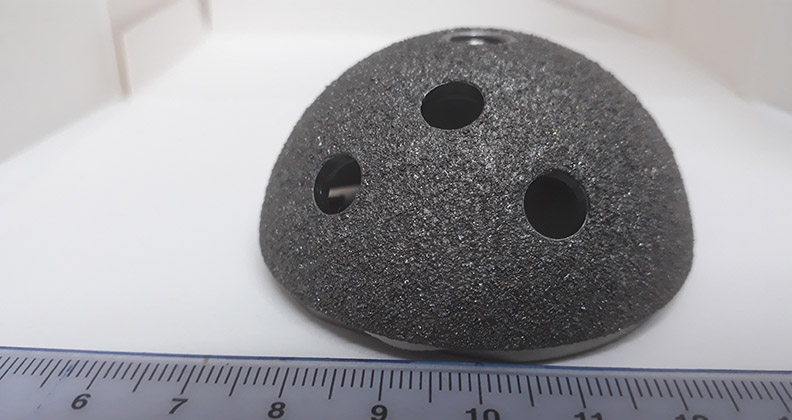

OSSTEC, a U.K.-based startup, is using AM to produce a partial knee implant with both articulating and porous cementless fixation surfaces in a single build process. The design supports biologic fixation and reflects two trends: the move toward cementless fixation and greater use of additive manufacturing.

CEO Maxwell Munford, Ph.D., has focused his research on replicating bone structures to promote biologic fixation.

“We realized that we could do some really cool things for cementless fixation,” Dr. Munford said. “What made it even more exciting was discovering that we could print to a higher density, which allowed us to polish surfaces for articulation.”

This integrated approach reduces manufacturing complexity, lowers production costs and avoids the risks of bonding a printed porous surface to a separately manufactured base.

“We’ve seen failures in other printed implants where the fixation layer shears off and recognized that as a technical issue,” Dr. Munford said. “Our goal was to eliminate that risk.”

Promoting Partial Knees. Partial knees are underused despite supportive clinical evidence.

“Studies show that up to 50% of patients are candidates for partial knees, but the procedure makes up only about 10% of the knee replacement market,” Dr. Munford said.

OSSTEC’s solution could help close that gap and make adoption easier for more surgeons. Its cementless partial knee aims to improve fixation, streamline surgical workflow and support better patient outcomes.

“Cementless uni knees have shown better outcomes in terms of morbidity, patient activity and recovery times,” Dr. Munford said. “They’re also more cost-effective in the short and long terms.”

From a supply chain perspective, OSSTEC’s single-process design eliminates bonding interfaces, reduces quality risks and allows scaling without added complexity.

Rethinking the Potential. For Orye, additive manufacturing’s value lies in how it changes business models.

“It’s not just about putting a lattice structure on a legacy design,” he said. “You need to rethink the whole approach, from functional integration, patient- or surgeon-specific solutions and using new materials like tantalum or nitinol. That’s where additive manufacturing shines.”

With adoption growing, orthopedic OEMs face pressure to apply additive manufacturing effectively. Those who treat it as a core innovation platform rather than a niche tool will be best positioned to outpace the competition.

“The market has moved beyond early adopters,” Orye said. “Additive manufacturing is no longer the differentiator. It’s how you use it that sets you apart.”

Read more about these topics in the full-length version of this article.

KK

Kendal Kloiber is a contributing editor.