Enovis is on quite a tear. The company cracked $1 billion in recon sales for the first time last year, staking a claim in the market’s top tier of orthopedic players.

The company’s future is just as promising, thanks to additional momentum from key product launches, the development of new shoulder and hip implants and next-gen applications for ARVIS, the company’s augmented reality (AR) navigation platform. Enovis expects total 2025 revenues between $2.19 billion and $2.22 billion, thanks to high-single-digit growth of its recon business.

Enovis has been notably successful with strategic M&A deals, including recent acquisitions of Novastep and LimaCorporate.

The company is also developing into a destination for leading minds in orthopedics who want to work in a culture of collaboration and innovation. It all adds up to Enovis being the deserving winner of the 2025 OMTEC Award for Bold Leadership. The company will be honored during an award ceremony before OMTEC’s Keynote Breakfast on Wednesday morning, June 18. Later in the day, representatives from the winning companies will share lessons learned and actionable advice at an engaging panel discussion,

Strategic Expansion

Gary Justak, President and General Manager of Enovis’ Foot & Ankle business, joined the company about 10 years ago. Back then, when it was known as DJO, Enovis was primarily focused on non-operative orthopedic care, but had a small surgical business that was one of the fastest growing players in that space.

The company’s leadership began to see potential beyond bracing and rehab. “From there, it became clear that we could expand into other orthopedic segments and build a much stronger surgical footprint,” Justak said.

Since about 2022, most of the company’s investment strategies have revolved around growing its global joint replacement and foot and ankle divisions. “I’ve been fortunate to be on the receiving end of a lot of that investment,” Justak said. “We built foot and ankle from scratch on the heels of six acquisitions, and our surgical business has expanded significantly, especially with the major acquisition of Lima.”

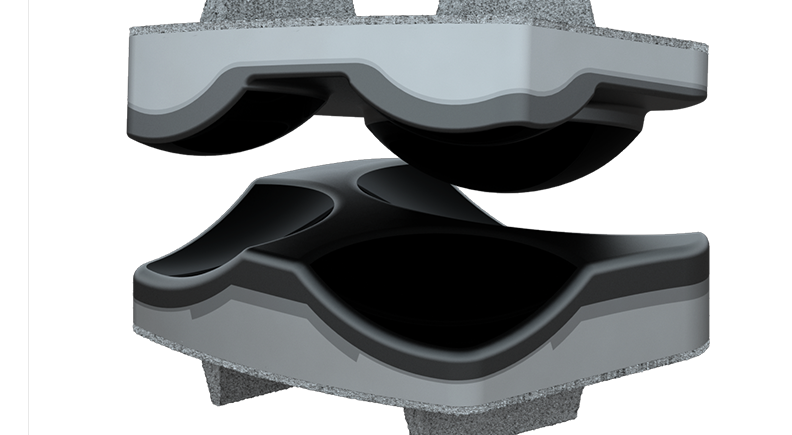

He’s referring, of course, to Enovis’ purchase of LimaCorporate in 2023 that added to the company’s organic growth. “Our surgical business in the U.S. was growing significantly, but our international footprint was limited,” Justak said. “Lima had deep experience in additive manufacturing, especially with trabecular titanium, and a strong global presence.”

The integration of the two companies, Justak noted, has been relatively seamless. “What’s made it work is cultural synergy, how both teams think and operate,” he said. “I’ve been through six acquisitions on the foot and ankle side, and that alignment is what makes the difference.”

The first year of integrating Lima into the established Enovis structure and culture was also a huge success on paper, as the legacy company generated over $320 million in 2024 through channel and organizational integrations.

That Lima acquisition complemented Enovis’ U.S. strengths and added international scale and scope. “It gave us tech, teams and reach,” Justak said. “And it’s made the global recon business about a 50/50 split between U.S. and international markets. That’s a big shift from where we were just a few years ago.”

Enovis also made a strategic bet on developing minimally invasive surgery (MIS) solutions in the foot and ankle segment with the 2023 acquisition of Novastep.

While many competitors have focused on high-volume procedures like bunion correction, Enovis has sought to capitalize on other opportunities in the foot and ankle space.

Justak said MIS has broader benefits in midfoot procedures, Charcot reconstruction, hindfoot fusion and calcaneal osteotomies. He added that Enovis is focused on reducing the learning curve for surgeons and making the procedures more repeatable.

Constant Innovation

Enovis’ leadership is dedicated to maintaining the company’s place among the top players in orthopedics. “That’s why we invest so heavily in R&D,” Justak said. “We’re solving real clinical problems, and if we do that, we’ll remain competitive.”

Enovis is committed to remaining near the top of a fiercely competitive industry. “Orthopedics is the smallest big market in healthcare,” Justak said. “Everyone’s chasing the same piece of pie. You’ve got to differentiate, whether that’s through enabling tech, materials science or implant design.”

On the joint replacement side, Justak pointed to a renewed focus on knees, hips and shoulders. Enovis’ surgical business was built on shoulder surgery solutions, including the first reverse shoulder system, and the company continues to build on that legacy. In the knee space, collaboration with Lima has led to new offerings like TT and EMPOWR cones. For hips, the emphasis is on supporting the shift to direct anterior approaches.

Enabling technology is an area of major investment for Enovis. “Everyone talks about robotics in large joints,” Justak said. “But we think there are other technologies that can improve repeatability with a smaller footprint.”

Enovis is building out its enabling technology offerings by developing next-level innovation within orthopedics. ARVIS is a prime example.

“It’s optical, highly accurate and more cost-effective than traditional robotic systems,” Justak said. “That makes it ideal for outpatient surgery, which is growing rapidly, especially in large joints.”

ARVIS also enhances the surgeon experience, according to Justak. “It keeps the surgeon in control, but gives them real-time data,” he said. “That combination improves surgical accuracy and helps standardize results.”

Enovis is eyeing future applications for ARVIS beyond hips and knees, particularly in shoulder surgery and foot and ankle applications.

As the number of practicing surgeons declines and the demand for procedures rises, developing technology solutions like ARVIS is paramount for orthopedic companies that want to stay ahead of the innovation curve.

“The biggest thing we hear from surgeons is, ‘Help me add one more case per day,’” Justak said. “That’s where enabling tech comes into play. It can make procedures much more repeatable and the learning curve easier for complicated procedures. We’re starting to integrate data to guide decision-making, because everything is moving toward outcome-based care powered by smarter technology.”

Creating a Destination

Underpinning Enovis’ growth-focused culture is an operating philosophy known as EGX (Enovis Growth Excellence) that is based on the Danaher business model and Toyota principles. “It’s about empowering teams to solve problems,” Justak said. “We say it all the time: don’t bring problems, bring solutions. EGX gives our teams the tools and the authority to do that.”

It’s also what makes Enovis feel like a startup, despite its growing global scale. “People join us because they want to build something,” Justak said. “That ownership culture is what sets us apart.”

Justak is confident that the company’s workplace culture will endure through a major leadership transition. In 2024, Brady Shirley announced he would retire from his position as President. In February 2025, CEO Matt Trerotola announced he was stepping down to spend more time with his family. Trerotola and Shirley led Colfax’s acquisition of DJO in 2019 and its spinoff into Enovis in 2022.

Enovis announced that Damian McDonald would guide the company forward. McDonald has more than 35 years of experience in the medical device industry.

“Matt has been an incredible leader. He challenged us to think differently and helped embed EGX into our culture,” Justak said. “Damian comes from a similar background in global medtech. He’s the right person to lead our next chapter of growth.”

Leadership at Enovis has set the tone for continued growth and innovation and will continue to scale the company’s vision. “It’s all about becoming global technology leaders while keeping that startup mentality,” Justak said. “We want to become a true destination in orthopedics where people can come to be a part of building the future.

“We’re expanding our engineering and technical capabilities across the board and strategic acquisitions have allowed us to increase our scope and scale. Our focus has always been on developing great leadership, great products and great talent.”

DC

Dan Cook is a Senior Editor at ORTHOWORLD. He develops content focused on important industry trends, top thought leaders and innovative technologies.