Nikon signed an investment agreement with SLM Solutions Group, a global leader in metal additive manufacturing (AM) solutions. In conjunction, Nikon AM, a direct subsidiary of Nikon, launched a voluntary public takeover offer for the acquisition of all outstanding shares of SLM for a cash consideration of €20.00/share. The total transaction value is €622 million (JPY 84 billion, US $616 million).

The transaction would allow SLM to continue to thrive in the developing space of metal AM. The acquisition of SLM expands Nikon’s portfolio of metal AM methods, which will enable Nikon to offer new solutions, win new business and expand its customer base.

Nikon has emphasized in the investment agreement that it intends SLM’s current management team to continue to lead the company and execute its strategy. Nikon also underlined its commitment to secure the future of SLM’s employee base, operational structures such as works councils, as well as SLM’s headquarters in Lübeck, Germany and other material operations.

Nikon has been a pioneer in optical technology markets worldwide since 1917. Today, the company offers a range of products that include semiconductor lithography systems, microscopes and measuring instruments for the healthcare field. In the future, Nikon plans to generate new core pillars of profit including the material processing business.

Nikon currently develops and sells optical processing machines that use the DED (Directed Energy Deposition) method of metal 3D printing, in which metal powder is injected and formed by applying a laser beam. Through this acquisition, Nikon gains access to the mainstream L-PBF (Laser Powder Bed Fusion) method.

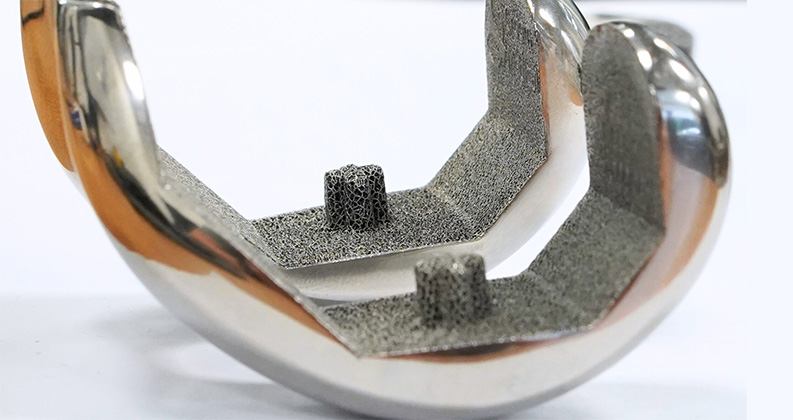

SLM Solutions is a global provider of integrated metal additive manufacturing solutions. Its metal additive manufacturing

machines feature up to 12 lasers and enable build rates of up to 1000 ccm/h.

In late 2016, GE had announced plans to acquire Arcam and SLM Solutions, suppliers of additive manufacturing equipment, for $1.4 billion in cash. Ultimately, the company abandoned its planned acquisition of SLM Solutions and increased the offer price for each Arcam share.

Source: Nikon

JAV

Julie A. Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.