From polymers to metals and biologics to synthetics, materials are often considered the root of innovation in orthopedics. They are the foundation of the devices of tomorrow that will ultimately improve patient outcomes and implant longevity.

Representatives from materials, device and consulting companies shared their thoughts on what advancements the orthopedic industry may see over the next couple of decades and the role materials will play in that change. They also highlighted the challenges and opportunities that will accompany the evolution of materials.

“Although the orthopedic market is a very mature market, it feels as though there hasn’t been a lot of material development that targets key issues from clinicians and patients,” said Kenneth Ross, Medical Group Manager, North & South America, High-Performance Polymers, Evonik Corporation. “It’s exciting to be on the cusp of a new horizon in material development and treatment options in a market with a storied history of clinical success and patient satisfaction, but which also has a well-identified need for further improvement.”

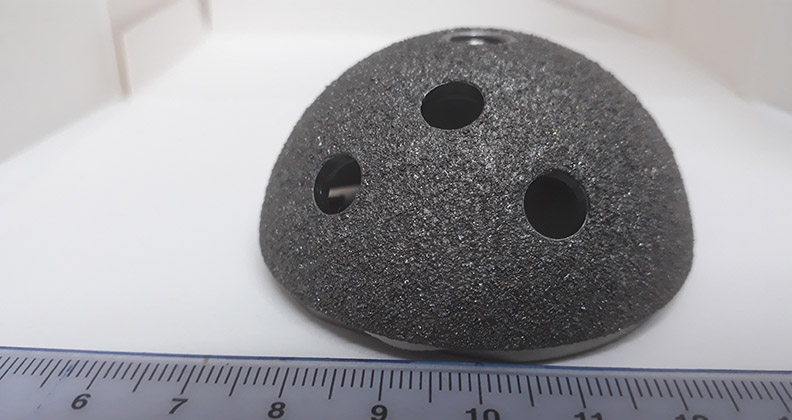

Additive and Custom Implants

Companies in the additive manufacturing medical device space forecast the entire market to have a compound annual growth rate (CAGR) of +20% from 2019 to 2024, according to AMPOWER’s interviews with suppliers and buyers. Advancements in additive manufacturing are enabled by advancements in materials, particularly high-quality metal powders.

“It’s two technologies developing simultaneously in a very big way,” said Art Kracke, President of AAK Consulting and a specialty metals executive.

Additive manufacturing is accelerating the transition from consuming solid Titanium 6-4 ELI bar mill products to fine powder particles. “It’s going to increase at an escalating rate,” Kracke said. “Twenty years is a very long time for innovation to occur. I believe that powdered metals could replace mill products within that timeframe.”

Kracke also sees melt-free titanium powder-making processes transitioning to full-rate production, enabling new, purer alloys with lower levels of residual elements than are inherent in today’s production.

As additive manufacturing machines and processes continue to improve, capital cost will decrease, leading to increased use and ultimately the large-scale adoption of the technology and patient-specific implants.

Ken Gall, Ph.D., Professor of Mechanical Engineering and Materials Science at Duke University and founder of orthopedic companies, sees patient-specific 3D-printed implants as the greatest material opportunity for device companies in the future.

“How do we mass customize a patient’s care?” he said. “You go in as a patient, get a CT scan or an MRI, they diagnose you and then that incredibly complex, three-dimensional reconstruction of your body is often thrown out—it’s crazy. I think creating implants based on one’s specific anatomy is one of the best opportunities to really change medicine.”

Dr. Gall said that additive manufacturing and creating efficiencies will be key to enabling custom implants. Machine learning algorithms can help make decisions based on current and past patient data to help bring down engineering costs and make the technology accessible to more routine surgeries.

“I think we’re going to see more pre-surgical planning and artificial intelligence taking data in on a more routine basis to help plan and evaluate surgery,” Dr. Gall said. “Companies that aren’t doing that are going to fall pretty far behind.”

Biologic and Regenerative Solutions

New materials and modifications to existing ones, like enhancing molecular surface properties to improve biocompatibility, will continue to accelerate the healing process.

“What I think you’re going to see in orthopedic materials and implants is the ability of the materials to bring properties that are not innate or inherent to the material itself,” said Gordon D. Donald, M.D., Founder and Chairman of Molecular Surface Technologies (MST). “The integration of biologic solutions and orthopedic implants will naturally lead to the development of smart implants that respond to the host environment.”

For instance, infection-prevention technologies are just now coming to light on a regulatory and commercial basis due to the financial demand (payors no longer reimbursing hospital-based acute infections) and product demand. Resorbable polymers provide another example. While polymers were highly acidic in the past and could cause inflammatory reactions, new polymers exist to prevent these issues. Dr. Donald notes that such new polymers are infinitely adjustable to customize them to each application.

“We can literally dial in how fast we want that implant to resorb or how fast we want that polymer to deliver drugs or growth factors or whatever it is that you’re trying to accomplish,” Dr. Donald said. “Biologics/regenerative solutions are the most exciting changes that we will witness in orthopedics over the next couple of decades. These solutions will not be purely drug or regenerative or tissue-engineered products, but will also require structural implants offering dynamic degrees of support and protection. You’re going to see biogenic applications where we can actually grow tissue to the implant itself, as opposed to growing it up to the surface of the implant. Overcoming functional deficits and, maybe more importantly, preventing/short-circuiting early-stage processes will actively engage healing at the cellular level and overcome the metal and plastic solutions of today.”

Challenges of Today and Tomorrow

While innovation is exciting, new materials aren’t brought to market with ease.

Mark Morrison, Ph.D., Senior Research Manager, Additive Manufacturing Center of Excellence, Smith+Nephew, said that ever-increasing requirements from regulatory authorities worldwide would be one of the most significant challenges to the advancements in orthopedic materials.

“These requirements are rightly particularly rigorous when it comes to new materials and revolutionary devices and designs,” he said. “Price pressures are combined with this hurdle to creating an environment where it can be difficult to produce large, meaningful improvements in orthopedic outcomes at a cost that the market will tolerate.”

Material development is a complicated process and requires a collaborative effort from the materials manufacturer, design engineers and product specialists from medical OEMs, said Gaurav Lalwani, Ph.D., Medical Applications Development Engineer, Carpenter Technology.

“Although most of the material development being conducted in the industry right now is in line with the customer needs, they are still enhancements over material systems that FDA has already approved for clinical use,” he said.

Ross of Evonik points out that, while most recalls are related to materials and their physical or chemical properties, and the development of new materials and process technology can help address drawbacks of existing materials, larger orthopedic company commitments to advancing future development don’t always match the commitment of the material suppliers’ research and development efforts.

“The large orthopedic companies are hesitant to apply new materials in their implants due to regulatory hurdles,” Ross said. “OEM patience and commitment to developing these materials, when historical materials will get a product to market faster, can often be a short-sited view.”

While developing a new alloy or a material system is a significant challenge due to hurdles associated with proving the safety and efficacy of the material and the medical device to FDA, Dr. Lalwani said that it could be extremely rewarding and differentiating for the medical OEM willing to accept that challenge.

Dr. Morrison of Smith+Nephew believes that innovations in materials come from a variety of sources.

“Material companies certainly play a part by introducing newer materials that provide value in medical devices,” he said. “Device manufacturers are often responsible for developing and introducing innovative materials and processes that improve the performance of medical devices. Finally, small startups are frequently the source of innovative materials and devices. Once these startups demonstrate that they have a viable product that fills a market need, these companies are often bought by large medical device OEMs.”

Dr. Gall, who co-founded MedShape (acquired by DJO), Vertera Spine (NuVasive) and restor3d (Kinos Medical), sees startups bridging the gap between universities conducting new material research and hesitation from orthopedic companies that control most of the market. But starting a device company with a new or enhanced material is complex. It requires teams and investors with a long-term perspective, finding universities and national labs with research targeted toward the biomedical field and the patience to educate to push change into the market with the right sales team.

Even with obstacles, Kracke said it’s critical for orthopedics to push for improvement to benefit patients and improve their lives, especially as athletics and trauma lead to more implants in younger people. “These devices need to last a lifetime,” he said. “That’s a big order.”

Also, as technologies become more affordable, more people around the world will benefit.

“In the Western world, we have the luxury that our medical systems have the highest global standards,” Kracke said. “Innovation will drive the orthopedic implant industry to the point where they’ll be more commonplace for people around the world.”

Kathie Taylor is a BONEZONE Contributor.