Anika Therapeutics signed agreements to acquire Parcus Medical, a sports medicine company, and Arthrosurface, a provider of joint surface and motion preservation products.

Anika will acquire Parcus for an upfront payment of approximately $35 million in cash, with an additional $60 million contingent upon achievement of certain commercial milestones. Arthrosurface’s acquisition is for an upfront payment of around $60 million, with an additional $40 million contingent upon achievement of certain regulatory and commercial milestones. The expected close for both transactions is 1Q20, with positive EBITDA and cash flow in 2021 and beyond.

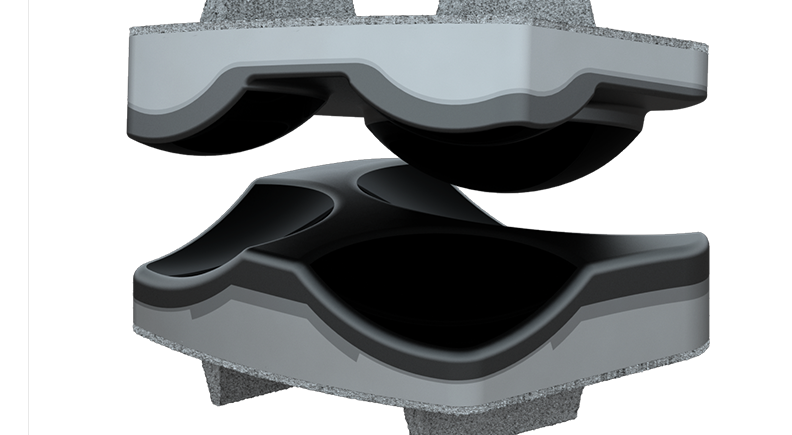

The acquisitions provide Anika an immediate implant portfolio. Parcus Medical’s portfolio of over 400 products has applications in sports medicine procedures that repair the shoulder, knee, hip, and distal extremities. Arthrosurface’s product portfolio includes more than 150 different surface implant curvatures for the knee, shoulder, hip, ankle, wrist, and toe to treat orthopedic conditions caused by trauma, injury and arthritis.

Per Anika’s management team, these acquisitions will increase the company’s total market opportunity by $7 billion and fast-track their transformation to a hybrid commercial organization with the addition of nearly 40 direct sales reps and over 200 distributors. Parcus Medical’s portfolio gives Anika direct access to a new call-point in ambulatory surgery centers, where unmet demand and a growing patient population will be growth tailwinds for several years. In addition to Arthrosurface’s innovative R&D pipeline, Anika will gain an expansive product portfolio with ample cross-selling opportunities due to the same sales call-point and procedural adjacency to current Anika offerings.

In sum, the acquisitions diversify Anika’s revenue streams and open opportunities for long-term double-digit sales growth.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.