Additive manufacturing (AM) is no longer a nice-to-have capability in orthopedics. OEMs that are seeking to differentiate their portfolios and meet evolving clinical demands view 3D printing as a critical tool for enabling faster innovation, greater design freedom and broader product offerings.

AM’s impact stretches far beyond latticed spinal cages and patient-specific implants. From improved manufacturing agility to enabling surgeon-specific instruments, the technology is helping companies remain on the forefront in a highly competitive industry.

“If you don’t capitalize on AM’s potential in orthopedics, you’re behind the competition,” said Davy Orye, Head of Additive Minds consulting at EOS, a provider of metal and polymer AM systems. “But just having additive isn’t enough anymore. Companies must understand how to leverage the technology to unlock its true advantages.”

Platform for Innovation

AM can provide the flexibility that traditional manufacturing methods can’t match for companies that are exploring new product categories or aiming to launch niche offerings with lower production volumes.

“Additive is a very flexible production technology,” Orye said. “You don’t need molds or tooling — you just need a digital file. That means even smaller companies can use the same machine to print hip cups, tibial trays, ankle implants and more.”

EOS’s Additive Minds division supports OEMs with design consulting, application development and qualification and validation, including regulatory guidance, to help them get to market quickly and efficiently.

“Additive unlocked the ability to control lattice structures in a way that was previously impossible,” Orye explained. “You can now precisely control geometry, porosity, relative density and even surface roughness. That’s become a standard differentiator in implant design.”

But the value extends well beyond structural innovation. Personalization is becoming essential in the development of new solutions.

“We talk a lot about patient-specific devices, but we’re also seeing demand for surgeon-specific instruments,” Orye said. “Every surgeon has a different technique or preference for handles or angles. Additive allows companies to make those variations cost-effectively.”

Startups often can’t afford the capital investment needed for printing machines and validations. Contract manufacturers with 3D printing capabilities offer a launchpad for bringing a differentiated product to market.

Then, if startups grow or get acquired, they can scale up AM production or transition it in-house, knowing that the same hardware and software ecosystem supports the move.

Larger OEMs often seek different benefits from contract manufacturers, such as redundancy across global sites, guaranteed supply capacity and validation support for high-volume applications.

“Additive allows companies to scale more fluidly across the product lifecycle, whether they’re in early development, high-volume production or winding down a legacy product,” Orye said. “It’s particularly valuable for producing the smallest and largest sizes, which are often needed in low quantities. In those cases, additive can be used alongside other production techniques to avoid the cost and delay of retooling or recasting.”

EOS helps customers build out repeatable, validated workflows so they can expand output while ensuring repeatability and reproducibility.

“We focus on first-time customers, helping them print reliably from the beginning,” Orye said. “This is especially important when manufacturing patient-specific implants.”

That underscores the transformational role of AM, not only as a cost-cutting or speed-enabling tool, but as a platform for solving previously unsolvable clinical problems.

While early applications of AM in orthopedics focused on high-value items like spinal cages and acetabular cups, declining per-part costs and faster print speeds are broadening the scope. AM is becoming viable for more standard implants like femoral components, especially when factoring in small-batch production or late-stage product life cycles.

“Additive used to be too expensive for large, traditional implants,” Orye said. “But now, with improvements in print speed, machine costs and material costs, it’s competitive.”

Building for a Cementless Future

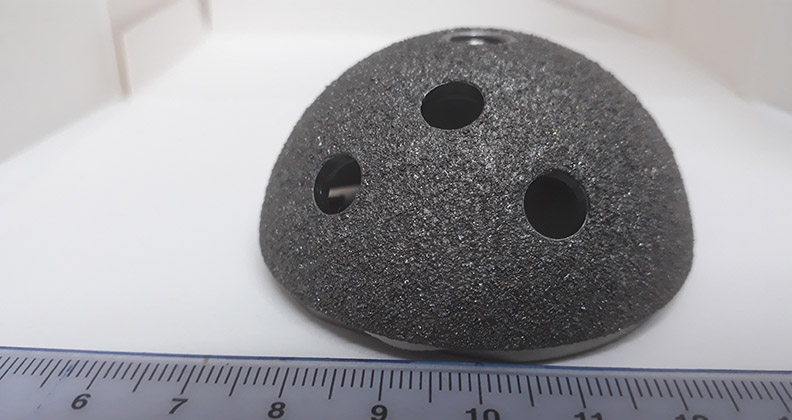

OSSTEC, an emerging U.K.-based startup, aims to lead the transformation of orthopedic implant design with a 3D-printed partial knee implant that combines articulating surfaces with biomimetic cementless fixation. The company is capitalizing on two intersecting trends: The shift toward cementless fixation and the growing use of AM.

Maxwell Munford, Ph.D., OSSTEC CEO, who has advanced degrees in mechanical engineering and AM, spent years researching 3D printing and ways to replicate bone structures to encourage biologic fixation. His exploration laid the foundation for OSSTEC’s unique implant platform.

“We realized that we could do some really cool things for cementless fixation,” Dr. Munford said. “What made it even more exciting was discovering that we could print to a higher density, which allowed us to polish surfaces for articulation.”

That capability unlocks significant technical, clinical and supply chain advantages.

“The innovation stems from our ability to combine the manufacturing of the porous fixation surface and articulating surface into a single process,” Dr. Munford said.

That’s a breakthrough that reduces manufacturing complexity and helps lower the cost of goods sold, according to Dr. Munford.

“Other companies have been printing porous materials for some time, but many of the implants currently on the market typically rely on a traditional casting or forging process to create the base implant, followed by 3D printing the porous structure on top,” he said.

That approach requires two separate manufacturing steps. More importantly, it introduces a potential fault line between the printed surface and the underlying substrate. “We’ve seen failures in other printed implants where the fixation layer shears off and recognized that as a technical issue,” Dr. Munford said. “Our goal was to eliminate that risk.”

OSSTEC’s team developed a process that prints both the articulating surface and the porous fixation surface in an integrated step.

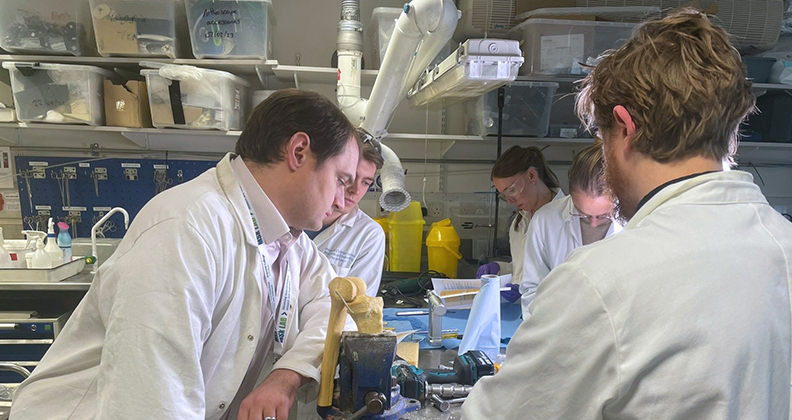

While cementless implants have been gaining traction in the U.S., cementless fixation has been popular in the U.K. for some time, and OSSTEC’s team has a longer history with the technique. Chief Medical Officer Alex Little, M.D., and Chief Technology Officer Jonathan Jeffers, Ph.D., saw opportunities to improve on traditional porous coatings and tackle some of the persistent issues with existing implant designs.

That clinical insight drove OSSTEC to pursue not just a better implant, but a better development process that’s rooted in research and surgeon collaboration.

“Surgeon involvement is core to our strategy,” Dr. Munford said. “We speak with our surgeons nearly every day. Yes, it can slow down development, but it results in a product that surgeons want to use.”

Creating a novel 3D-printed implant design that balances engineering, clinical needs and regulatory compliance can be difficult. Dr. Munford points to that intersection as one of the toughest but most rewarding aspects of OSSTEC’s journey.

“You’ve got engineers chasing technical perfection, surgeons focused on usability and outcomes and regulators ensuring patient safety — and sometimes those goals conflict,” he said. “The real challenge is finding common ground that satisfies all three.”

In OSSTEC’s case, that meant making tough trade-offs between development speed and clinical thoroughness. Getting to market quickly doesn’t mean you’ve done it right. OSSTEC prioritized testing beyond regulatory requirements, conducting micro-motion testing and fracture analysis and running multiple animal studies.

“FDA provides a solid regulatory framework, but it’s not exhaustive,” Dr. Munford said. “We’ve conducted a series of tests that FDA doesn’t mandate. That’s not because we want to waste time and money. We want to know if the product we make works correctly.”

OSSTEC’s cementless partial knee aims to solve multiple clinical and practical challenges: biologic fixation, streamlined surgical workflows and patient outcomes.

“Cementless unis have shown better outcomes in terms of morbidity, patient activity and recovery times,” Dr. Munford said. “They’re also more cost-effective in the short and long term.”

OSSTEC has also developed a surgical technique and instrumentation that support surgeons with varying degrees of experience in performing uni knees.

“We’ve built instrumentation that’s intuitive and adaptable with clear visual cues, minimal steps and no cement to deal with,” Dr. Munford said. “Surgeons can perform procedures with our implant in under 30 minutes. All our surgeons perform their partial knees in outpatient settings, and going cementless allows them to perform more procedures and help more patients. That’s a big part of the value proposition.”

OSSTEC’s single-process approach also removes complexity and cost from the supply chain. “We eliminate the interface issue entirely, and we’re able to scale without adding process steps or quality risks,” Dr. Munford explained.

Partial knees are underutilized and Dr. Munford sees that as a challenge rooted in surgeon education.

“Studies show that up to 50% of patients are candidates for partial knees, but the procedure makes up only about 10% of the knee replacement market,” he said. “That’s a huge gap.”

OSSTEC’s cementless implant could help close it. “Because our system is intuitive and doesn’t require extensive joint access, it’s well-suited for more surgeons to adopt.”

Design engineers must continually advance additive manufacturing to stay ahead of the competition.

Productive Applications

Contract manufacturers work closely with customers to deliver on their specific go-to-market strategy. The key is understanding that AM’s real value lies in how it changes business models, not only product design and development.

“It’s not just about putting a lattice structure on a legacy design,” Orye said. “You need to rethink the whole approach, from functional integration, patient- or surgeon-specific solutions and using new materials like tantalum or nitinol. That’s where additive shines.”

As AM adoption grows, orthopedic OEMs are under increasing pressure not just to use 3D printing, but to apply it effectively. Companies that embrace AM as a core innovation platform, rather than a novelty or niche capability, will be best positioned to capitalize on its benefits.

“The market has moved beyond early adopters,” Orye said. “Additive is no longer the differentiator. It’s how you use it that sets you apart.”

KK

Kendal Kloiber is a contributing editor.