An affiliate of the private investment firm SK Capital Partners entered into exclusive negotiations with LISI Group to acquire LISI Group’s Medical division.

Though subject to various approvals, the transaction is expected to close in the second half of 2025.

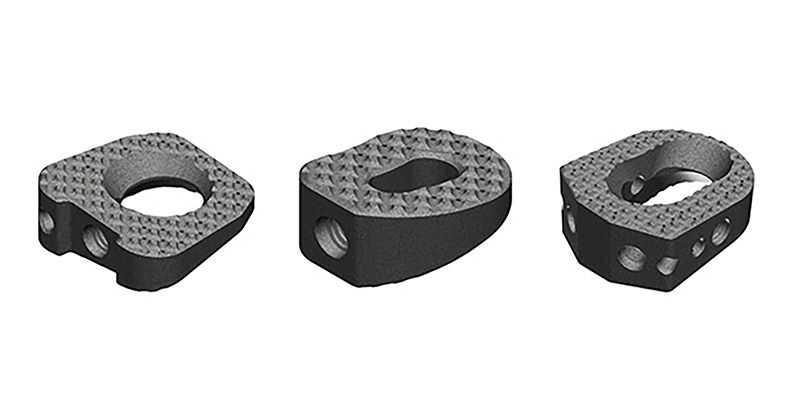

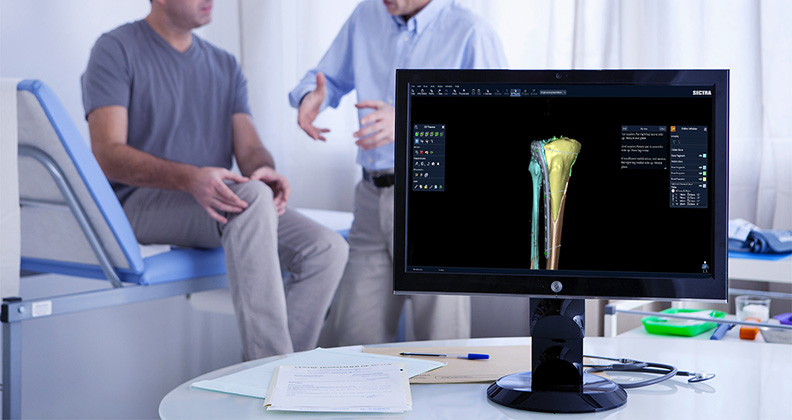

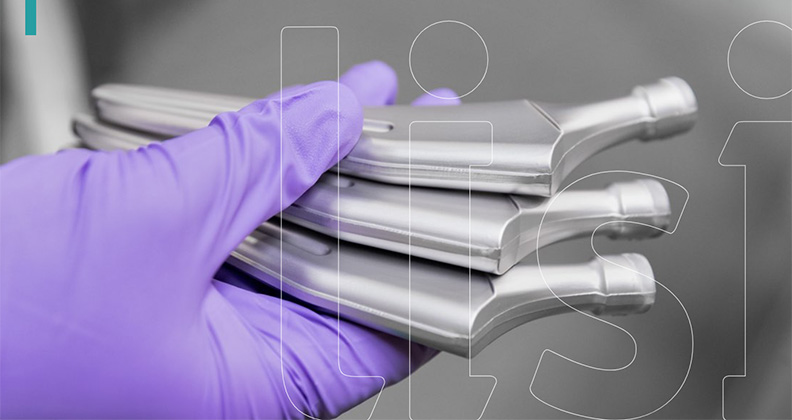

Lisi Medical is a leading contract manufacturer focused on the production of high-precision metal components and assemblies serving global medical device original equipment manufacturers (OEMs). The company’s products include instruments utilized in minimally invasive and robotic-assisted surgery as well as orthopedic implants. Lisi Medical operates four manufacturing sites with expertise in precision machining, forging and engineering solutions, including highly automated production – two in Minnesota, U.S. and two in France.

Josh Lieberman, Principal at SK Capital, commented, “We feel privileged to partner with LISI Group to acquire Lisi Medical, whose deep engineering heritage and cutting-edge manufacturing technologies enable it to serve as a critical solutions provider for the world’s largest MedTech OEM customers. Under LISI Group’s ownership, the Company has made significant investments to increase automation, expand production capacity, and add capabilities to support the growth of its customers. We look forward to working with Lisi Medical’s management team to accelerate the Company’s growth by expanding with existing and new customers and continuing to add new capabilities both organically and through M&A.”

Aaron Davenport, Managing Director at SK Capital, added, “Given Lisi Medical’s highly engineered solutions and deep relationships with leading MedTech customers, the Company fits very well within the SK Capital portfolio. SK Capital has deep experience in the life sciences CDMO sector and a long-standing track record of carving out businesses and establishing them as thriving, independent platforms, and we believe Lisi Medical represents an attractive opportunity to implement our transformational growth strategy.”

Emmanuel Viellard, CEO of LISI Group, stated, “After 14 years of strong development and manufacturing consolidation within LISI Group, we are now looking forward to partnering with SK Capital and boosting LISI Medical’s next development phase. Their strong track record in the life sciences sector and proven experience in France provide the essential strategic foresight and financial power to support the company going forward. This will also empower Lisi Medical to expand its offerings and capabilities, while solidifying its standing as a top-tier partner for leading MedTech OEMs. We are confident this transaction will be beneficial to all stakeholders of Lisi Medical, be it employees, clients or suppliers.”

Source: SK Capital

JAV

Julie A. Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.