Ahead of the NASS’ Annual Meeting, we highlighted multiple market drivers in spine: motion-preserving implants, enabling technologies and mergers and acquisitions. These trends were discussed in nearly every conversation we had with spine companies, surgeons and academic researchers at the Annual Meeting in Los Angeles.

Companies are highly focused on R&D efforts while keeping their operations lean and efficient in hopes of being acquired or having capital to be the acquirer. This recap highlights three technologies that speak to the overarching trends we learned about at NASS.

3Spine is undergoing an IDE pivotal trial and RWE clinical fusion study for its MOTUS lumbar total joint replacement system.

Bringing Joint Replacement to Spine

Motion preservation is gaining interest in spine as startups enter clinical and commercialization phases with novel technologies. Those with tenure in the spine market remember the wave of interest in motion preservation in the early 2000s that brought new artificial discs to the market. While activity has shifted in the space over the years, companies continue to work on differentiated implants and techniques.

3Spine, a clinical phase company, is developing a lumbar total joint replacement solution as an alternative to spinal fusion. The company had a significant presence at NASS.

The company’s MOTUS implant uses a bilateral posterior technique to preserve natural balance and retain the spine’s range of motion. The total joint replacement procedure is indicated for the biomechanical reconstruction and stabilization of a spinal motion segment following decompression at one lumbar level from L1/L2 to L5/S1. MOTUS received FDA Breakthrough Device designation and Investigational Device Exemption (IDE) approval, and 3Spine is undergoing an IDE pivotal trial and a Real-world Evidence clinical fusion study.

“MOTUS is the first implant to address all pain generators while preserving mobility,” said Scott Hodges, D.O., Co-founder and Medical Director of 3Spine. “Artificial disc replacement works extremely well for back pain, and it is very encouraging to also see superiority data for facet replacement over fusion. MOTUS replaces the function of the disc and facet, allowing broad decompression, realignment of spinal balance, restoration of the disc, segmental re-stabilization, etc. Total joint replacement allows you to correct the whole problem, including posture. We believe this is why we see such an immediate difference in MOTUS patients compared to fusion. We’re treating the whole disease.”

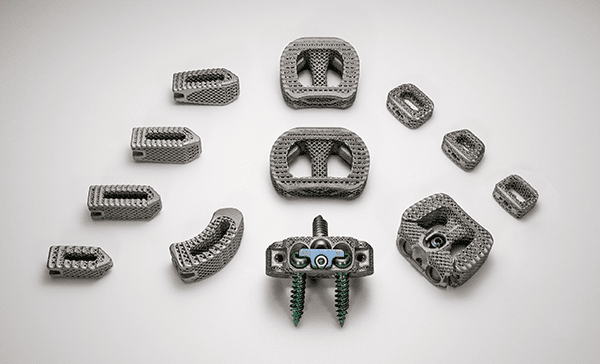

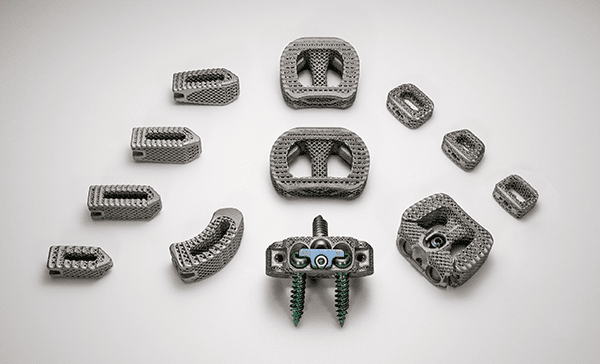

A new collaboration plans to leverage NanoHive’s proprietary spinal fusion Soft Titanium (pictured above) and DirectSync Surgical’s work on stimulating/sensing implants.

Developing Smart Implants

The application of smart implants has risen in recent years as companies seek to track a patient’s healing process and collect significant amounts of data that can be used to further R&D and personalized medicine efforts. Multiple spine companies have products in development.

NanoHive Medical and DirectSync Surgical recently finalized a deal to develop a stimulating/sensing 3D-printed fusion cage. The collaboration is focused on two initiatives. The first is to integrate patient-powered stimulation into NanoHive’s 3D-printed implants, with the goal of expediting fusion and potentially mitigating the use of biologics. The second is to equip surgeons with a postoperative data analysis tool.

“We wanted to take a technology leap,” said Patrick O’Donnell, NanoHive’s CEO. “We were watching what’s happening with wearables and AI technology. We’re seeing several insurance companies pinching, trying to reduce the number of spinal surgeries by making authorizations very difficult for surgeons and their patients. Combine that with the GPOs trying to reduce costs by minimizing the number of players in their institution. We’ve asked ourselves, how do we make sure that we’re out in front of these trends?”

O’Donnell said that NanoHive’s technology could impact all stakeholders in the patient care chain. Patients might not need as many follow-up x-rays. Surgeons could monitor patients remotely and gather significant amounts of clinical data. Payers and GPOs seek more clinical data, and they reward innovation.

“The postoperative applications are really attractive to me,” O’Donnell said.

Stryker’s Q Guidance Spine System was used in 2,400 surgeries in its first year on the market.

Advancing Procedures with Enabling Technology

Although preoperative planning, navigation and robotics are not new in spine, they have not gained broad adoption. We continue to see new companies commercialize systems with smaller footprints and a lower price point in hopes of gaining market share and improving adoption rates. Of course, the largest spine companies are launching enhancements to technology already on the market.

Stryker featured its Q Guidance System at NASS and said that it completed 2,400 spine surgeries with the technology in its first year. Q Guidance delivers speed with the flexibility of multiple optical tracking methods, including full-spectrum active/passive hybrid optical tracking, semi-automatic and automatic processing features, gesture recognition and compatibility with various types of image sets. Company executives said they continue to experience significant interest in enabling technology from surgeons, including those who have previously tried it but did not adopt. Stryker is also on track to release its Mako Spine application in 2024.

“We’re seeing surgeons who want to integrate these technologies into their practice, because they can help them perform surgery with greater confidence, accuracy and efficiency. That says that the technology is maturing,” said Keith Evans, Vice President and General Manager of Enabling Technology at Stryker. “As we start thinking about robotics or adding powered instrumentation with navigation and additional intelligence, we can show surgeons something they haven’t seen before. We believe that’s the next frontier. There are preoperative and postoperative technologies that wrap around these other systems, which will be a big deal. Our focus now and next year is on building out the full complement of technologies in the O.R. and then adding preoperative and postoperative capabilities.”

Further, surgeons are interested in using data from technology to ensure they’ve picked the proper procedure and implant for the patient, said Josh Johnson, Vice President and General Manager of Core Spine at Stryker. More data points will help surgeons think comprehensively about procedures, a trend that has already begun.

“Surgeons are taking a more holistic approach to their first intervention than they did a decade ago,” he said. “They used to treat spine ailments at individual levels. We know that the first intervention in spine is typically not their last. Now, surgeons are taking a broader, longer-term thinking on that first intervention. How might they treat patients during the first procedure to prolong or, ideally, put off having to perform a second intervention? Time will tell, and data will prove whether that thinking improves patient care.”

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.