Centinel Spine recently received FDA premarket approval (PMA) for three total cervical disc replacement devices in their prodisc family of products. A PMA for prodisc C Vivo, prodisc C Nova, and prodisc C SK now join the already available prodisc C implant with one-level indications. The recent approvals give Centinel Spine a broad offering of total disc replacement (TDR) solutions, making it the only spine company to offer implant design options.

Centinel Spine has been at the forefront of advancing motion preservation through their unique clinical and regulatory strategy, not just in cervical disc replacement but also lumbar disc replacement. Other companies in motion preservation have performed Investigational Device Exemption (IDE) studies and commercialized technology. Still, there has been little to no advancement in further developing the implants after premarket approval.

The prodisc line was acquired by Centinel Spine from DePuy Synthes (JNJ) in late 2017. Since then, Centinel Spine has received a PMA supplement to transition manufacturing from JNJ, gained two-level approval for prodisc L, launched anatomic endplates for prodisc L, and now has received a one-level PMA supplement for prodisc C Vivo, SK and Nova.

Internationally, the company has offered a variety of endplate designs ideal for varying anatomy and pathology from patient to patient or even within an individual patient’s spine for several years. Additionally, they have been enrolling patients in a U.S. IDE study for two-level cervical use of prodisc using prodisc C Vivo and prodisc C SK.

“While COVID brought unexpected challenges as we got the two-level cervical study rolling, our collective and increasing experience with our disc options around the world made us increasingly confident as we persevered through the one-level PMA Supplement process,” said Steven Murray, CEO. “FDA was very thorough in its review. Getting the recent approvals on three unique devices was a major achievement.”

The Difference is at the Core

The prodisc is the most studied orthopedic implant in the world, with more than 500 clinical papers published, according to the company. There have been more than 225,000 prodisc implantations globally with less than a 1% revision rate. With the new anatomic endplates of prodisc C Vivo, SK and Nova, surgeons can now choose the best disc for the operative level of each patient.

“The variety of cervical total disc configurations, coupled with the well-documented CORE technology, represents a major advancement in patient care,” Murray said. “We have had tremendous success in lumbar disc arthroplasty when we launched the anatomic endplates in the U.S. with 40% growth on average over the past eight quarters.”

The prodisc technology platform is based on prodisc CORE Technology, an articulating implant design incorporating a fixed core optimized to provide stability and predictable motion. This feature remains central to all prodisc devices and is advantageous compared to other artificial disc devices available in the U.S., which are based on a variable core, according to Murray.

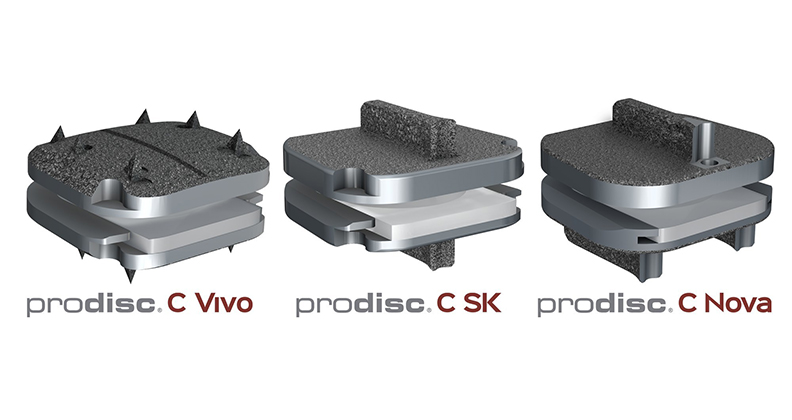

“The differences behind the four FDA-approved prodisc C devices lie in the anatomic endplate designs,” he said. “prodisc C is well-known, has been implanted in the U.S. since 2007 and utilizes flat endplates with larger central keels.

“prodisc C Vivo has no keel, achieving fixation through small lateral spikes in the endplates, as well as a convex domed superior endplate that is ideal for many patients. prodisc C SK has a 50% smaller keel than the original prodisc C and is perfect when a lesser keeled device is desired. The prodisc C Nova implant incorporates a unique tri-keel design that will be useful in certain patient morphologies. We believe that options to best fit each patient’s anatomy will be useful to the surgeon.”

Patient anatomy and pathology vary, but until now, surgeons have had just one choice from each cervical disc manufacturer requiring the surgeon to “fit the patient to the disc.” Centinel Spine now offers multiple cervical disc options to allow the surgeon to “match the disc to the patient.”

Optionality based on patient anatomy and disease severity, as well as surgeon choice, follows a similar approach to other joint technology platforms, like in hip and knee replacement. These markets have expanded and helped many more patients as better design options were made available to surgeons.

“We have seen this phenomenon in the lumbar disc arthroplasty segment with our prodisc Lanatomic endplates launch in 2021, allowing more options for pelvic balancing,” Murray said.

Centinel Spine recently sponsored an independent survey in the U.S. through IQVIA with 100+ spine orthopedic and neurosurgeons. The survey results showed that 85% of the surgeons found value in differentiated endplate shapes/fixation options.

Fitting Into the Global TDR Market

The total disc market is one of the fastest growing segments in spine. Murray estimates the TDR market is growing 12% to 15% annually worldwide. The market continues to grow in double digits for the next several years, with the U.S. market on the higher end of that range and Europe on the lower end.

“Europe is more mature from an adoption perspective vs. the U.S.,” he said. “Increasingly, patients are becoming aware of TDR and asking if it is a suitable solution for them when surgery is required, especially in the U.S. The TDR market is vastly underpenetrated. We are bullish on the global TDR market far into the future. In both the U.S. and Europe, we see more surgeons differentiating and expanding their practices by offering TDR solutions to patients.”

TDR is a proven best procedure for many patients, and clinical literature backs that up. In the cervical market, insurance coverage is nearly 100%. Murray estimates that it is 85% and growing in the lumbar TDR market; therefore, patient coverage is much less of an issue than in the past.

“Surgeon reimbursement continues to be a challenge in some areas, but the differential between fusion and motion preservation is lessening year-to-year,” he said.

The biggest hurdle for Centinel Spine today is surgeon comfort with TDR in a larger portion of their patient population and patient awareness of the procedure.

“We think we are approaching a tipping point in the market where TDR will become more of the standard of care,” Murray said. “We see TDR doubling in both the cervical and lumbar market within five years. The dynamics of patient interest, better implant choices and demographics all point in a positive direction.”

For the internal Centinel Spine team, the PMA is the culmination of hard work and perseverance. Considerably more complex than a 510(k) clearance, PMAs take years to gather data and receive approval.

Moreover, a core value of the company is to put the patient at the center of all they do.

“We hear from patients about the difference our products and our people make, and it’s a huge motivator for our company,” Murray said. “Our mission is to be a leader in this category. So for us, this is really important as an organization. The team rallies behind that mission because we know how important technology like this is for patients. It’s motion preservation technology, and that’s more accepted in big joints and extremities, but in the spine it’s still somewhat of an emerging area.”

Centinel Spine launched prodisc C Vivo in a targeted way in September and will be launching prodisc C SK in a targeted manner at the NASS Annual Meeting in October. The national launch for Vivo and SK will occur during the first quarter of 2023, and prodisc C Nova will launch in the back half of 2023. The company will continue to offer their well-known prodisc C.

HT

Heather Tunstall is a BONEZONE Contributor.