Followers of orthopedic contract manufacturing M&A know that ARCH Medical Solutions is on a tear.

The company has completed 15 acquisitions since 2016. Four of those have taken place this year, including the purchase of Amplify Additive and MedTorque.

The Michigan-based company now has 18 locations that combine for 700,000 square feet of manufacturing space in the United States. ARCH doesn’t plan to stop there.

ARCH Global Holdings, the parent company of the medical solutions business, sold its aerospace & defense business in 2021 to focus more on its medical segment. The company is actively entertaining acquisitions on a regular basis. Approximately 60% of ARCH Medical Solutions’ business is orthopedics, and it’s likely that future acquisitions will impact the space.

We connected with John Ruggieri, Senior Vice President of Business Development, about the company’s M&A strategy and what it means for their capabilities and OEM customers. Ruggieri himself came to ARCH via the acquisition of Seabrook International in 2017.

M&A Strategy

What criteria do you use when looking for and ultimately purchasing a company?

Ruggieri: First and foremost, we look for businesses whose cultural attributes align with ours in how we serve our customers and treat our employees.

Second, we look for well-run businesses, ideally with senior leadership that wishes to continue with the business under ARCH. It is often the case that sellers who stay on post-transaction also wish to invest in the platform going forward.

Third, we look for businesses that have developed valued customer relationships that can be expanded upon with additional support and resources.

Companies that fit the ARCH Medical Solutions model have several key characteristics. These organizations come with historical success in serving the medical device market with a prominent customer base. The commitment from the existing management team to continue with ARCH, creating continuity of business, is an important factor. Exhibiting stability in financial performance and a track record for sustaining growth are also important attributes.

The acquired company will typically have an area of expertise and be known by their customers for their abilities in the markets they serve. The most important attribute we look for involves ensuring the organization to be acquired has a well-established culture that fits with the ARCH model: a fast-paced, growth-oriented, employee-centric organization with an unwavering commitment to the success of the customers we serve.

What’s the goal of your M&A strategy?

Ruggieri: Our goal is simple: to be the most highly sought-after contract manufacturer of medical devices in the industry. Beyond that, we aim to be diverse in our capabilities, product and service offering, and geographic footprint to best serve our customers’ needs.

While we seek to be the most sought-after med device manufacturer, it does not necessarily mean that we’re the biggest. However, it does require capabilities at an adequate scale and vertical integration to engage in projects with the world’s largest OEMs. The criteria to be part of that, per above, is stringent. But we are constantly looking for organizations that share our mission to join the ARCH network.

Capabilities and Markets

You are very focused on the U.S. orthopedic market. Do you plan to expand outside the U.S.?

Ruggieri: You are correct in that we have been domestically focused. We have considered opportunities for OUS expansion when presented. As we grow our platform, we are becoming increasingly interested, and will continue to evaluate OUS-based opportunities with the right partners.

How has your M&A activity expanded your capabilities?

Ruggieri: We currently participate widely in orthopedics with surgical instruments and implants. We have intentionally expanded the end markets we support, particularly in areas where our core competencies can be leveraged to provide differentiated manufacturing and support services. The added end-market diversification also helps offset the natural cycles in most individual medical device end markets.

From our origins in orthopedic implants and instruments, we have expanded into several additional market areas. Critical components for surgical robotic systems is one of those sectors. Our experience manufacturing robotic components expands the surgical procedures we address, well beyond orthopedics and into soft tissue and neurological surgeries. Many of our ortho-based customers are benefiting from our decades of experience as those OEMs introduce their own robots to the world.

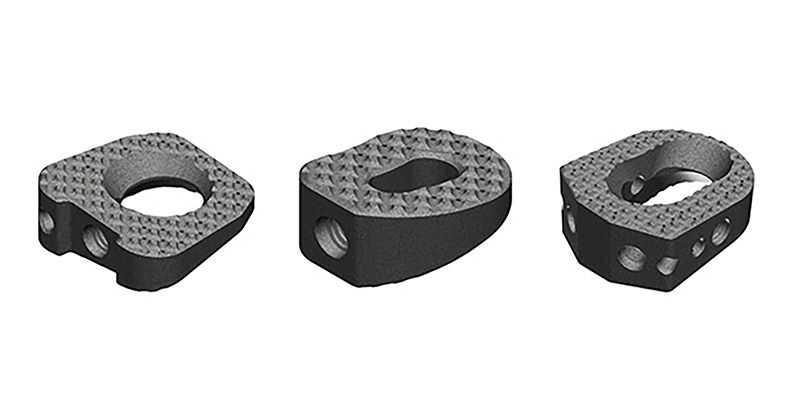

We entered other markets for cardiovascular and dental to complement our expertise in large joint, spine, extremities and trauma devices. We have also added competencies in laboratory and diagnostic component manufacturing. Other service offerings have been added, including additive manufacturing capabilities with a deep knowledge base for how those technologies support our medical device customers. A German instruments catalog, torque limiting devices for surgical applications, and silicone over-molding capabilities for surgical instruments and handles help round out our offerings.

What capabilities do you seek to add and expand in the future?

Ruggieri: We are quite strong in machined metals and plastics, but have an ongoing interest in expansion toward highly functional and critical molded components and products.

As is always the case, we have an open ear to our customers for where they are experiencing pain points in their outsourced manufacturing and supply chain needs. Their perspectives help us to evaluate where we can help either organically or via M&A.

Additionally, we’re continuing to pursue diversification in various medical device markets where we either do not participate today, or have only limited exposure and capabilities.

Company and Customer Integration

How has your growth changed the makeup of your customer base?

Ruggieri: With each acquisition, we pick up new customers. But equally as important, we often broaden our presence with existing customers as a result of our expansion of capabilities through our M&A efforts.

We also emphasize the need to support customers of all sizes and types. We feel strongly that the new market entrants and those with varying needs have the potential to develop into critical players. We seek to be there for them as they introduce new and compelling products to the marketplace.

To the earlier point about medical device end-market diversification, we continue to evaluate growth opportunities within and beyond those currently served, which results in the ongoing expansion of our customer base.

Our origins in ARCH Medical Solutions began with a dozen or so key customers. Today we serve several hundred different customers across our expansive manufacturing footprint. This includes all of the top medical OEMs in their various markets and many companies just below that stature. Most of our key customers are directly served by multiple ARCH facilities.

M&A integration is complex for the companies involved and their customers. How are you handling the acquisition integrations? What lessons have you learned along the way?

Ruggieri: We try to stick to the principle of only integrating where it makes sense and preserving autonomy or independence where required to preserve and maximize customer service.

We use key ingredients when joining one of our newly acquired companies with ARCH. These companies were successful before joining ARCH, and served a customer base that counted on them to perform. Their performance and their relationship with their customers are what ARCH sought in the acquisition process. Their attributes made the acquired company stand out to us among their peers.

Our strategy is preserving performance for their customers, continued relationships with those customers, and creating a nearly imperceivable (by our customers) transition into the ARCH network. Providing the acquired organization with the necessary resources to support their customers and fuel organic growth while sharing the best of their operating practices with the best of the ARCH practices creates a win for all involved. This approach has been critical to our successful integration and onboarding activities.

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.