Historically, Europe has been regarded as an innovator in medical devices and an easy and quick market to access. Orthopedic companies would launch in Europe, collect data, then bring their product or technology to the U.S. for FDA clearance. This strategy allowed companies to start earning revenue as they sought regulatory clearance in the U.S.

Since the EU introduced its stricter Medical Devices Regulation (MDR) in 2017, there has been buzz about a pendulum swing regarding where companies are taking their products to market first. When the first phase of MDR rules went into effect in 2021, that buzz got louder, and a shift to the U.S. accelerated.

A recent survey and report by Boston Consulting Group (BCG) and UCLA Biodesign explores this shift and its motivations.

“We have noticed that profound changes took place within the medtech industry over the past decade,” said Gunnar Trommer, Ph.D., Managing Director and Partner at BCG Digital Ventures. “Those of us at BCG and UCLA Biodesign are always curious, and we wanted to gauge the impact that these shifts have had and the role they’ve played in overturning legacy processes, introducing exciting new possibilities. In the report, we see how go-to-market preferences in this space have evolved significantly — a trend that will likely continue to change along with the pace of innovation.”

The report is based on a survey of 102 companies that provided information on 105 medical devices, technologies and software that have achieved regulatory clearance or approval from FDA. The respondents included public and private companies and products in all risk classes.

Across the board, the survey found that medtech companies now seek to launch their new technology in the U.S. first.

Why the Switch?

The EU has implemented a more restrictive regulation with MDR and, as is familiar with any major regulatory overhaul, has fumbled execution of its rollout. Now, the common thought is that FDA has responded more effectively to advances in innovation than Europe has. In fact, 53% of survey respondents said they are deprioritizing the CE Mark relative to U.S. FDA approval, and 79% agreed that FDA is responding well to advances in medical technology.

“There was consensus across industry segments with respect to CE Marking becoming a lower priority in the global regulatory market,” said Jennifer McCaney, Ph.D., Co-Executive Director at UCLA Biodesign.

Specifically, the survey found that FDA’s Breakthrough Device Designation is widely perceived as an important program that fast tracks medtech innovation. We’ve seen more than 65 orthopedic companies enter the designated pathway.

FDA’s more straightforward regulatory pathway for novel devices, coupled with the new guidance on emerging technologies like artificial intelligence and machine learning (AI/ML), helps explain why 89% of the companies who launched products in EU markets said they will prioritize U.S. regulatory approval going forward. Additionally, 23% of respondents with successful CE Mark products will pursue Japanese and Chinese registration before EU clearance. They cited EU MDR rules as complex and unpredictable with a tendency to slow the pace of innovation.

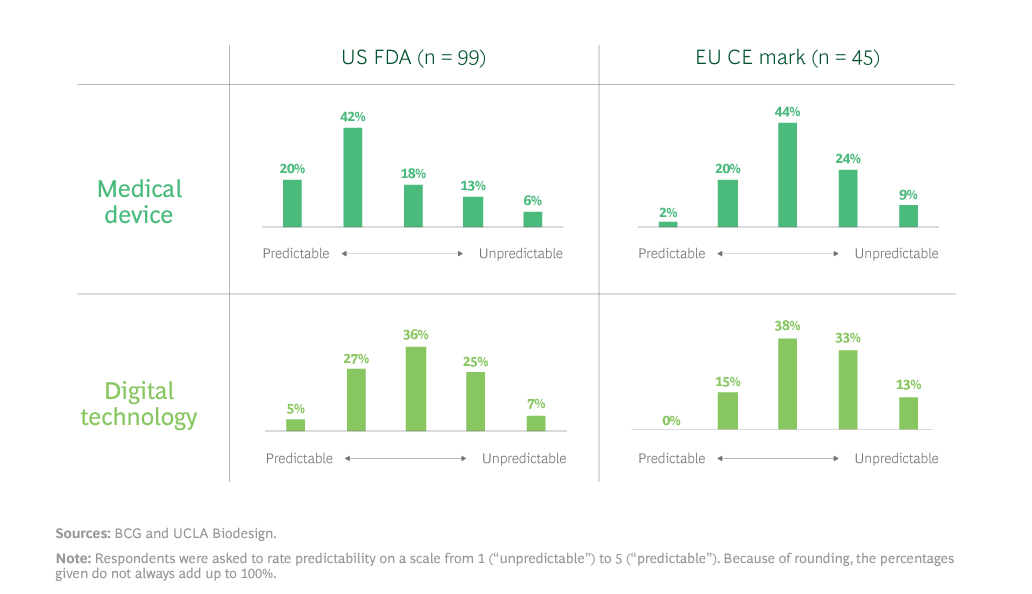

Exhibit 1 shows survey respondents’ thoughts on the predictability of the U.S. and EU regulatory pathways.

“This is really interesting when you consider that only a decade ago, companies opted to launch innovations in Europe first because it was the quicker path to market,” Dr. Trommer said. “These findings would indicate that’s not necessarily the case anymore. In the U.S., for instance, FDA has pretty significantly shifted its level of receptiveness to health tech innovation in recent years.”

Still, the U.S. faces challenges regarding coverage and reimbursement for new products, particularly digital technologies. If not managed properly, those reimbursement challenges may hinder innovation, according to Dr. Trommer.

Overcoming Existing U.S. Hurdles

Companies must have viable reimbursement and regulatory pathways to be effective at developing and bringing new solutions to market.

“FDA’s heightened level of receptiveness to innovation overall helped streamline this process,” Dr. Trommer said. “In our study, 55 of 73 CEOs and business leaders view reimbursement as the key impediment to innovation. Beyond that, product innovations that incorporate AI and machine learning call for more clarity with regard to regulatory requirements.”

Orthopedics is experiencing a significant focus on digital innovation as the most prominent players seek to become technology companies and not just implant companies. Increasing product innovation incorporating AI/ML necessitates greater clarity on regulatory requirements and more reviewer expertise.

“When looking at the intersection of orthopedics and emerging trends in the medtech sector with respect to digitization, the pathway to reimbursement is not yet clearly defined for those at the forefront of new technology,” Dr. McCaney said.

Dr. McCaney explained that for new devices seeking to intervene earlier in the progression of a disease area, it is unclear how payors will recognize the benefit of the technologies for patients in the long term. Companies bringing digitally-connected offerings coupled with traditional implants have an advantage in being able to hedge the downside risk of uncertain payment for preventative treatments by capturing new revenue streams through remote patient monitoring, she said.

“This strategy offers additional security surrounding the limited payment structure of selling products embedded into bundled procedures,” Dr. McCaney said. “Device manufacturers can develop additional offerings to further improve patient quality of life as they become a co-pilot in the longitudinal patient journey through digital connectivity. As software and hardware converge, companies in the study continue to seek feedback from the FDA on how to navigate combined or solo regulatory filings for digital and device components as well as determine the strategic benefits with respect to timing and cost.”

What Does All This Mean?

The reality is that orthopedics — and all of medtech — is a global business.

We estimate that the $53 billion orthopedic market derives roughly 18% of its sales from the EMEA region. Companies will continue to sell in Europe because of the significant demand for orthopedic implants and technology. However, we expect orthopedic companies to be more selective with the products they keep on the market and pursue for future CE Marks. Additionally, we foresee European device companies with innovative technology targeting the U.S. for initial market access.

The U.S. market represents about 66% of the global orthopedic market, by our estimates. It’s plausible that the number will continue to grow in the coming years.

HT

Heather Tunstall is a BONEZONE Contributor.