The global orthopedic market declined by $5.6 billion (-10.6%) from 2019 to 2020, due to unprecedented challenges and uncertainty brought on by the COVID-19 pandemic. Widespread surgical restrictions and cancellations resulted in monumental revenue losses and lags for orthopedic companies. Ultimately, orthopedic revenue declined from $53.1 billion in 2019 to $47.5 billion in 2020, according to our estimates published in THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT ®.

The pandemic is expected to persist through 2021, obstructing most companies from a swift return to normalcy and growth. That said, we project 2021 revenue to surpass 2019 by +2.5%. The return of procedures, especially in the U.S. – the largest orthopedic market – is fueling orthopedic sales. However, there are underlying factors in each of orthopedic’s market segments that will spur growth in 2021 and beyond.

Orthopedic Market Performance

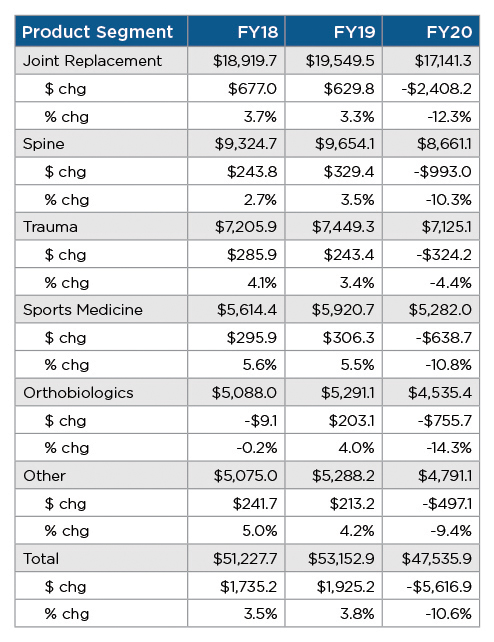

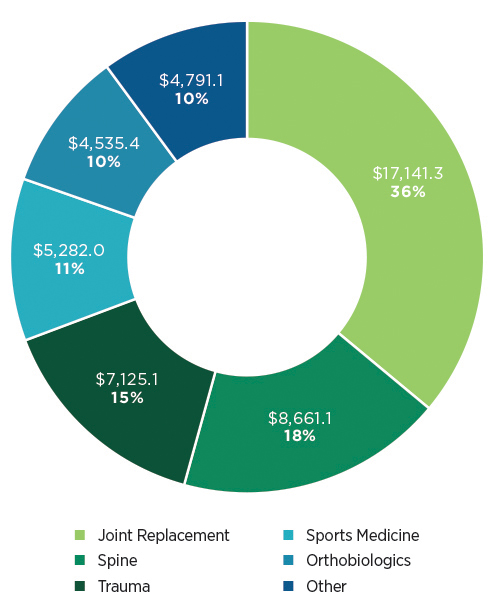

No orthopedic market segment was immune from the negative impacts of the pandemic. Joint replacement suffered one of the larger declines at -12.3% and trauma realized the least decline at -4.4% from 2019 to 2020. Exhibits 1 and 2 detail orthopedic product segment sales and product segment sales by market share.

Exhibit 1: Orthopedic Product Segment Sales – 2018 to 2020 ($Millions)

Exhibit 2: Orthopedic Product Segments by 2020 Market Share

The key developments and emerging storylines for each segment are summarized below.

Joint Replacement: Enabling technology, extremities and ASCs

- Pandemic-related procedure deferrals and cancellations negatively impacted the segment, especially knee replacement.

- Enabling technology capital sales showed remarkable resilience compared to implant sales.

- Players increased their strategic focus on ASCs in 2020 to prepare for future procedure shifts.

- Extremity joint replacement market, especially foot and ankle, remains highly fragmented and likely to consolidate in the coming years.

Spine: Pure-play companies and enabling technology

- Pure-play spine companies outperformed their diversified counterparts once again.

- Enabling technology sales hit record all-time highs in 2020 despite hospital spending constraints.

- A fundamental transformation is underway in spine as some players shift primary focus from implants to technology.

Trauma: Consolidation and more consolidation

- With its acquisition of Wright Medical complete, Stryker faces an integration between the two trauma divisions, as competitors standby to pounce on any dis-synergies that arise.

- Further consolidation is expected in the market as larger players with fledgling trauma businesses remain aggressive with bolt-on acquisitions.

Sports Medicine: Capital sales and ASC synergies

- Capital sales in sports medicine were depressed and did not share the success of joint replacement and spine.

- Sports medicine provides a synergistic entry point to ASCs for diversified orthopedic companies and top-tier players increased their focus on the segment during 2020.

Orthobiologics: Viscosupplements and regenerative therapies

- The viscosupplement market continued its shift toward single injection products in 2020.

- Companies are finding profitable market adjacencies by leveraging hyaluronic acid for regenerative therapies like soft tissue augmentation.

We estimate that 1,000 companies compete in the orthopedic space. While the above list is not exhaustive, it highlights major trends taking place with the top-tier companies in each market segment.

Let’s take a deeper look at some of these trends.

Key Orthopedic Trends

For more than a year, we’ve been tracking three key trends in orthopedics: the adoption of enabling technology, consolidation of companies and the shift of procedures from the hospital to the outpatient or ASC setting.

Enabling Technology Sales Weathering the Storm

Enabling technology capital sales performed far better than expected in 2020 against the backdrop of financially constrained hospitals. As the orthopedic market bottomed out in April and May, some device company leaders questioned the wisdom of even broaching the subject with hospital executives. However, hospitals continued to invest in enabling technology tied to profitable elective procedures like joint replacement and spinal fusion. From the industry side, orthopedic companies will continue to develop and iterate upon their enabling technology because of its ties to driving implant revenue.

Medtronic’s President Geoffrey Martha explained the resilience of certain types of capital equipment, saying, “Our capital products tend to be tied to profitable elective procedures like spine, so that helps. The other thing is providing flexible financing. Although there is some pressure on general capital, when that capital is supporting an elective procedure that is profitable and critical to the hospital’s financial recovery, they’re continuing to have these conversations with us.”

Robotic systems for joint replacement also saw significant demand. Stryker continued finding success with Mako placements. We estimate that the company has 1,150 Mako units in the field, an increase of +33% compared to last year. Zimmer Biomet surpassed 200 robotic placements in the third quarter of 2020, while Smith+Nephew placed their first CORI system in 2Q20.

Companies in other segments struggled with capital sales in 2020. ConMed’s arthroscopic capital sales declined approximately -19% compared to 2019. ConMed President and CEO Curt Hartman said, “What we’re hearing from customers is now is not the time for us to be evaluating capital technology, and we’ve got a lot of other priorities right now, and we need to get back into surgery. We need to get revenue-generating procedures back into facilities. So, we’re not pushing hard on capital. It’s not what customers want to hear from us right now.”

Brisk Cadence of Tuck-In Acquisitions

We tracked 38 OEM deals in orthopedics for 2020, compared to 38 in 2019 and 30 in 2018. While we’ll probably not see another acquisition the size of the recently closed Stryker purchase of Wright Medical any time soon, the ripple effects of that deal will create opportunities for growth and market share shift, specifically in the foot and ankle segments. The fragmented spine market and the still novel enabling technology market are also ripe for acquisition targets. We expect cash-rich companies will continue to look for tuck-in acquisitions to gain access to new revenue streams, niche products or specialized salesforces and technology expertise.

Zimmer Biomet anticipates disruption at Stryker during the integration of Wright Medical. “I would be very happy if there was disruption when you try to bring those two organizations together finally. The fact is, most of the time in our industry, bringing two organizations together is a dis-synergy risk. I would expect, given the historical view of acquisitions in our space, that we have an opportunity to take advantage of that. We have a very clear strategy in our extremities business,” said Bryan Hanson, Zimmer Biomet’s President and CEO.

DJO purchased Stryker’s STAR ankle system as part of the regulatory approval for the Wright Medical deal. Shortly thereafter, Smith+Nephew acquired Integra LifeScience’s orthopedics business, potentially as a counter move to DJO. Colfax, DJO’s parent company, believes the foot and ankle joint replacement market’s high fragmentation offers multiple acquisition-related growth paths. The company followed up its STAR ankle purchase with the January 2021 purchase of foot-and ankle-player Trilliant Surgical and the April 2021 purchase of MedShape.

In the spine segment, Medtronic bolstered Mazor’s capabilities with the acquisition of Medicrea’s surgical planning software, while Surgalign purchased HoloSurgical for its augmented reality and artificial intelligence (ARAI) platform. Zimmer Biomet divested its spine and dental businesses to focus on its core markets.

ASCs Are the Next Orthopedic Battleground

The shift of orthopedic procedures into ASCs continued in 2020. However, the COVID-related shift brought only modest, and likely transient, acceleration of procedures moving to outpatient settings. These facilities’ numbers and capacity remain well below the threshold needed to support the explosive growth predicted by many industry observers. We expect increasing momentum for outpatient settings, especially with the Centers for Medicare & Medicaid Services removing approximately 300 primarily musculoskeletal-related services from in-patient only lists and covering total hip replacement in ASCs.

For now, penetration remains low for ASC spine and large joint procedures, even among companies that focus on those settings like Smith+Nephew and NuVasive. Approximately 10% of

Smith+Nephew’s knee replacement revenue comes from ASCs, while NuVasive characterized its ASC revenue as single digits comprising lower complexity cases.

“When we talk about the ASC in spine, we need to be deliberate around what specific procedural opportunities are best associated with that type of shift in care. Un-instrumented lumbar procedures, decompressions, discectomies and the like are commonly done on an outpatient basis. It’s time to evolve. We see across orthopedics a desire to leverage those alternate care settings,” said NuVasive Executive Vice President and CFO Matt Harbaugh.

It may be some time before ASCs truly reach critical mass in capacity and capability, but the largest orthopedic companies are increasingly focused on positioning themselves for that time. Both Smith+Nephew (CORI) and DePuy Synthes (VELYS) are deploying ASC-optimized robotics. Zimmer Biomet increased investment in its Sports Medicine franchise throughout 2020, including the acquisitions of Incisive and Relign in 3Q20. Stryker and Acumed are two examples of a recent surge of device companies offering all-in-one ASC plans that include inventory, pricing, billing and financing.

The increased focus paid off for Stryker in the third quarter. Company Chairman and CEO Kevin Lobo said, “We’re very pleased with our performance in ASCs. Mako’s number in ASCs in the third quarter was the highest we’ve had so far, so Mako is part of the solution. We had double-digit growth in our sports medicine business that plays in the ASC primarily. We tend to operate separately, by product category, in the hospital, but we’re not doing that in the ASC. Our aligned offerings are working very well.”

The COVID pandemic brought profound disruption and change to the orthopedic market in 2020. However, the adaptability of companies and care providers offset more severe losses. While the pandemic is still a factor in 2021, we expect further improvement throughout the balance of the year as regional markets rebound and eventually normalize. Further, we expect companies to execute strategies around enabling technology, M&A and ASCs to drive growth.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.