In the joint replacement market, larger companies have already shifted R&D resources from implant innovation to a focus on developing robots, navigation and planning software and apps.

This shift in development doesn’t mean the end of evolution for hip and knee implants. To the contrary, hundreds of small and medium companies that believe there’s room for implant improvement are finding the space and flexibility to refine their existing product lines.

The intent of the updated designs is meant to translate to improved product design, which benefits patients both in the short term (quicker recovery time, less post-surgery pain, a more personalized and precise fit) and longer-term (improved range of motion, reduced chance of needing a revision). However, in recent years, the evolution of technology – or what MicroPort Orthopedics Chief Technology Officer Paul Bryant calls a “digital transformation” – is creating a joint replacement market that’s more competitive and dynamic.

“There are several advanced digital-based technologies being introduced to the market, and these enabling technologies can bring about a number of benefits for providers and patients,” he said. “Additionally, there’s the continued alignment of surgeons and hospitals which will further drive towards greater value-based and cost-effective solutions that provide real benefits to patients.” Surgeons are also “taking ownership in managing the quality and costs of what they do,” Bryant added.

Ashesh Shah, President, CEO and Co-founder of Maxx Orthopedics, connects the latter fact to the evolution of joint replacement surgery itself. Not only are hospitals and regulators pushing surgeons need to be more efficient, but the age range of people needing hip and knee implants has dropped; in a shift from how things were a decade ago, it’s now common to see patients in their early 50s having these procedures.

“What we hear is a completeness of portfolio matters, because surgeons want versatility,” Shah says. “As the user base has expanded, the demand on the implant and on that surgery has expanded. And when that poly does wear down, they don’t want to call in the kitchen sink and do a revision. They need easy ways to pop out the poly and swap it. Today, what we hear is versatility, efficiency, price sensitivity, even with hospitals.”

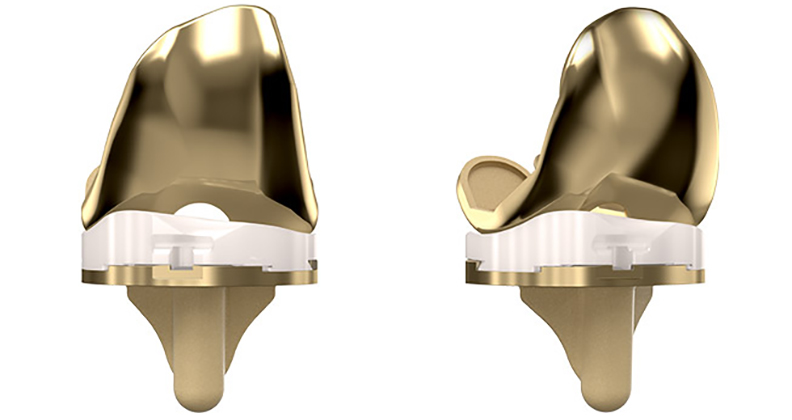

Maxx Orthopedics Freedom Knee

Focus on Design and Technique

Founded in 2006, Maxx Ortho first launched the Freedom Total Knee System. Their portfolio offers a robust selection of sizes, so patients of varying anatomies experience a more precise fit, and a design that preserves range of motion. “We had the benefit of being able to see what others have done before, and build a new sizing scheme and articulating surface that allowed us to have what is now common, but back then was uncommon, which is a high-flex implant system that did not sacrifice additional bone,” Shah says.

The company has since received FDA 510(k) clearance to market the Freedom Ultra-Congruent liner, which boasts more constraint to add stability. They also launched the Libertas® Hip System in 2019, followed in 2020 with the commercial launch and first successful surgeries using the Libertas Taper Reduced Uncemented Femoral Stem, which has three neck angles and a distal taper shape that reduces the risk of fractures.

NextStep Arthropedix, a division of the Theken Group, is also refining their hip replacement implants. In 2019, they launched The Blade, a femoral stem component for their iNSitu Total Hip system. Calibrated to be used with the direct anterior approach, it has a reduced lateral shoulder and a much shorter lateral sweep at the distal tip.

However, MicroPort Orthopedics, which is also completing the Evolution Revision Knee System, credits its success to pairing implant improvements with guidance for surgeons on best practices. “It’s really a combination of the implant design and the surgical approach,” Bryant said. For example, he noted the AnteriorPATH technique for hips “utilizes a portal to gain direct access to the hip socket, offering a surgeon direct visualization and preparation” that’s led to better wound healing and fewer wound-related complications. MicroPort Orthopedics also recently launched a Kinematic Alignment (KA) approach for the Evolution Medial-Pivot Knee, a surgical technique that ensures the implant mimics the natural alignment of a patient’s joint in its healthier state.

MicroPort Orthopedics Gladiator Hip Stems

Concentration on Materials and Manufacturing

In addition to implant design, companies are considering new materials and manufacturing processes.

Another Theken Group firm is revolutionizing materials. Ə Ceramics is poised to be the second company on the joint replacement market to manufacture its own ceramic implantable material. After acquiring a ceramic material from BioPro Medical in 2019, it’s developing components for knee and hip systems, such as a femoral head.

“Our ceramic dates back 35-plus years and has been implanted in patients longer than any other ceramic material with zero in vivo failures over this timeframe,” said NextStep Arthropedix Founder Randy Theken, who oversees the suite of companies under the Theken Group. He cites the sturdiness and safety of their ceramic implantable material as a major plus over the competition.

Ə Ceramics’ offering is also suitable for patients with metal sensitivities, which is top of mind for one of the latest offerings from MicroPort Orthopedics. The company initially launched its medial-pivot knee system in 1998 and, over the years, its portfolio has become known for its stability and durability.

“What we’ve been focused on more recently is building around the Evolution Knee System by developing and commercializing key extensions on the base knee system,” Bryant said. That includes the Evolution NitrX Knee, an implant with a titanium niobium nitride coating that reduces the release of metal ions into the body.

Maxx Orthopedics is also working toward developing novel biomaterials. “I think the idea of a complete metal-free knee is in our near future now,” Shah saif. “And that opens up a whole world of technology.”

He also views additive manufacturing as a particularly transformative technology, as it could lead to implants that are more personalized and precise, and made out of different materials

NextStep Arthropedix was an early adopter of developing hip implant components using additive manufacturing. “Our 3D-printed Acetabular Cup allows for bone ‘in-growth,’ versus the competitive systems have ‘on-growth’ where bone attaches only to the surface of the cup,” Theken said. “Our cup allows for bone growth into the pores of the cup.”

NextStep Arthropedix 3D-printed Acetabular Cup

Adoption of Technology

While smaller companies are not launching vast enabling technology platforms, they are still considering the digital evolution in orthopedics. They see that underpinning improved design, technique and cutting-edge materials are newer technologies.

“Manufacturing technologies, artificial intelligence, machine learning and other enabling technologies can help us develop more personalized solutions for our patients,” Bryant said, “where we can connect the best implants and surgical approach for each patient to drive towards better outcomes.”

In 2020, MicroPort completed a robotic-assisted total knee replacement with its Skywalker Joint Replacement Robot in a human trial in China. NextStep Arthropedix is developing microelectronics for both inventory systems and surgical devices.

Maxx Orthopedics’ Shah envisions a future of incorporating machine learning and software into work. “The pace of advancement in those [areas] is so much faster than what it was traditionally in med devices and certainly, healthcare at large. It does feel like every year, better, better, better—more and more innovation.” He cautions that innovation needs to be purposeful, however. “It’s no longer the case that you can have an innovation and just charge more for it. We never built our company that way, but now, I don’t think even the market will accept that.”

Bryant said that MicroPort Orthopedics is also “transitioning into a technology-based orthopedic solutions provider” so they can leverage innovation. “We’ve been active in the enabling technology space by utilizing virtual reality technology to support our sales and medical education initiatives and have deployed patient management applications.”

He also sees analytics and data increasingly having an impact on decision-making, specifically data around patient outcomes. “Collecting the right data, understanding and utilizing this data in such a way that helps us provide better pathways and solutions for surgeons and their patients.” For example, historical information about implants, surgical approaches and patient responses can help direct future decisions on care plans and protocols. “We’re moving into a data-driven age, but it’s not just capturing data for the sake of having it,” Bryant said. “It’s knowing what to do with it once you have it.”

Consideration of Procedure Settings

The Ambulatory Surgery Center (ASC) market is quickly growing and gaining more attention from joint replacement companies. Market intelligence firm Sg2 predicts that orthopedic procedures will grow +31% in ambulatory settings and will decrease -11% in the inpatient setting between 2019 and 2029. The combination of the COVID-19 pandemic and new CMS reimbursement – as well as patients wanting quicker post-joint replacement rehab – is intensifying the shift of procedures.

“Way back when, it was all about pain relief for surgeons and their patients,” Bryant said. “I think we’ve answered the pain question—now everything’s moving to patient satisfaction. Patients just want to get their normal life back.”

Because space is at a premium at ASCs compared to hospitals, companies are focused on compact and portable solutions. For example, Maxx Ortho has a one-tray system for outpatient joint replacement, while NextStep Arthropedix has designed a two-tray hip implant system to streamline procedures for staff. NextStep also recently acquired the exclusive rights and product for a surgical table required to perform anterior hip surgery. The table folds up and can fit in a closet to provide ASCs with space flexibility.

At the end of the day, Bryant said all of these evolutions benefit all stakeholders.

“It’s looking at providing solutions more broadly than just the implants. It’s not just about the implants anymore. It’s about the overall solution that an implant provider can provide to not only a surgeon and their patients, but the other providers, like the ASC, or even the hospitals.”

Annie Zaleski is a BONEZONE Contributor.