After spending some time recently in ORTHOWORLD’s Mergers & Acquisitions Database, it seemed to me that the volume of reported M&A actions in the supplier space was keeping pace with the OEM space—and was maybe even on the rise.

Not one to accept a “feeling,” I printed out the Excel version and set to marking it up—one color for OEM activities, the other for Supplier/Service Providers. (I left out ownership transfers and focused on transactions that broadened or complemented the capabilities of the acquirer.)

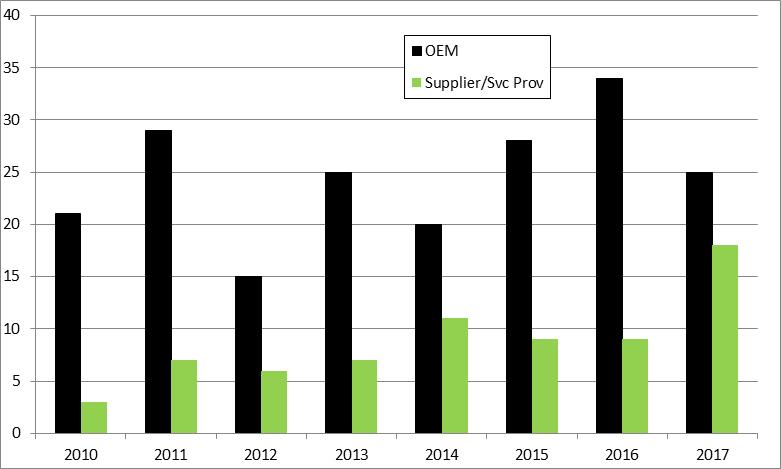

Here’s what the results looked like:

Publicly-reported OEM and Supplier/Service Provider M&A Activity, 2010 to 2017

The vertical axis represents number of transactions occurring in the years shown across the bottom.

Here was confirmation of my hunch: over an eight-year span, the gap between the number of OEM transactions vs. those in the supplier space was its narrowest in 2017. (OEMs 26, Suppliers 18: a difference of 8. The next closest gap was 9, in 2012 and 2014.)

What does it signify?

First, that the natural course of events is unfolding; suppliers are responding and reacting to the heightened OEM M&A activity that occurred in the last few years. It’s no surprise that the response is coming up to three years after the OEM transactions, since it takes time for the effects of those transactions to be felt at the operational and financial levels of the supply base.

Second, OEMs (particularly those responsible for supplier quality and purchasing) can expect to lose (or to gain) partners as a result of increased supplier M&A.

Third, Tier 2 and Tier 3 suppliers can expect to gain new customers—new and bigger customers.

What’s prompting these transactions? Well, that’s another article. Suffice to say, though, that OEMs are pressured to reduce their supply bases and limit their exposure to risk with quality, compliance and the sheer number of people to manage. Suppliers are seizing the opportunity to join forces and position themselves as full service solutions providers.

David Finch, BONEZONE author and OMTEC speaker, has asked, “What do you do when an important supplier is merged with or acquired by another that isn’t approved to supply specific components, instruments or implants previously supplied by the acquired company? If the decision is forced on you, the concerns and risks remain the same but without the benefit of time or ability to decide not to proceed. With the recent M&A activity in the supplier space, all OEMs should prepare for this scenario.”

Catch up on his tips from BONEZONE:

Be Prepared When Suppliers are Acquired

The Forgotten Phases of M&A:

JAV

Julie A. Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.